|

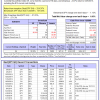

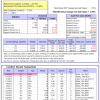

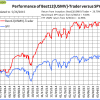

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 78 days, and showing a -2.47% return to 5/26/2015. Over the previous week the market value of Best(SPY-SH) gained 1.06% at a time when SPY gained -1.13% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $354,370 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

|

|

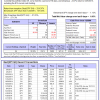

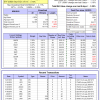

The iM-Combo3 portfolio currently holds SH, XLV, and TLT so far held for an average period of 208 days, and showing a 6.73% return to 5/26/2015. Over the previous week the market value of iM-Combo3 gained 0.92% at a time when SPY gained -1.13% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,160 which includes $3,492 in cash and excludes $1,231 in fees and slippage. |

|

|

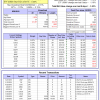

The iM-Best(Short) portfolio currently has 3 short position. Over the previous week the market value of Best(Short) gained 0.98% at a time when SPY gained -1.13% Over the period 1/2/2009 to 5/26/2015 the starting capital of $100,000 would have grown to $106,305 which is net of $18,205 fees and slippage. |

|

|

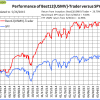

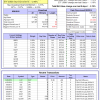

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 8 of them winners, so far held for an average period of 34 days, and showing combined -3.56% average return to 5/26/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -3.47% at a time when SPY gained -1.13% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $823,283 which includes $41 cash and excludes $67,045 spent on fees and slippage. |

|

|

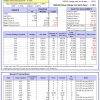

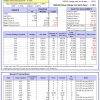

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 9 of them winners, so far held for an average period of 136 days, and showing combined 4.84% average return to 5/26/2015. Since inception, on 1/5/2014, the model gained 5.76% while the benchmark SPY gained 4.92% and the ETF USMV gained 3.74% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.08% at a time when SPY gained -1.13% A starting capital of $100,000 at inception of 1/5/2015 would have grown to $105,756 which includes $658 cash and excludes $134 spent on fees and slippage. |

|

|

The iM-Best12(USMV)Q2-Investor currently holds 12 stocks, 6 of them winners, so far held for an average period of 57 days, and showing combined -1.50% average return to 5/26/2015. Since inception, on 3/30/2015, the model gained -1.28% while the benchmark SPY gained 1.18% and the ETF USMV gained 0.20% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -1.53% at a time when SPY gained -1.13% A starting capital of $100,000 at inception of 1/5/2015 would have grown to $98,723 which includes $645 cash and excludes $99 spent on fees and slippage. |

|

|

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 312 days and showing combined 23.98% average return to 5/26/2015. Since inception, on 6/30/2014, the model gained 23.73% while the benchmark SPY gained 9.18% and the ETF USMV gained 12.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained -3.19% at a time when SPY gained -1.13% A starting capital of $100,000 at inception on 6/30/2014 has grown to $123,728 which includes $28 cash and $129 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 219 days, and showing combined 17.05% average return to 5/26/2015. Since inception, on 9/29/2014, the model gained 16.23% while the benchmark SPY gained 7.72% and the ETF USMV gained 11.40% over the same period. Over the previous week the market value of iM-Best12(USMV)-Q4 gained -2.46% at a time when SPY gained -1.13% . A starting capital of $100,000 at inception on 9/29/2014 has grown to $116,315 which includes $3 cash and $132 for fees and slippage. |

|

|

Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 17.95% over SPY. (see iM-USMV Investor Portfolio) |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 6 of them winners, so far held for an average period of 94 days, and showing combined 5.55% average return to 5/26/2015. Since inception, on 6/30/2014, the model gained 26.79% while the benchmark SPY gained 9.18% and the ETF USMV gained 12.96% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.02% at a time when SPY gained -1.13% . A starting capital of $100,000 at inception on 6/30/2014 has grown to $126,792 which includes $335 cash and $1000 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 245 days, and showing combined 7.09% average return to 5/26/2015. Since inception, on 6/30/2014, the model gained 16.64% while the benchmark SPY gained 9.18% and the VDIGX gained 8.47% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -1.15% at a time when SPY gained -1.13% . A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,643 which includes $514 cash and $328 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.