|

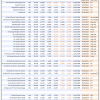

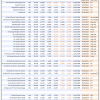

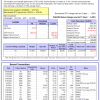

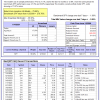

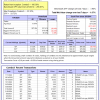

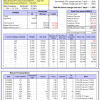

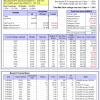

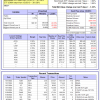

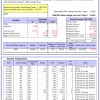

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

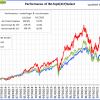

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -10.5%, and for the last 12 months is -9.6%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -2.12% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $118,768,508 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -1.43% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $595,495 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 8.9%, and for the last 12 months is 15.3%. Over the same period the benchmark E60B40 performance was 13.2% and 22.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.06% at a time when SPY gained -1.14%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $168,725 which includes $772 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 16.5%. Over the same period the benchmark E60B40 performance was 13.2% and 22.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.23% at a time when SPY gained -1.14%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $176,080 which includes $617 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 10.7%, and for the last 12 months is 17.6%. Over the same period the benchmark E60B40 performance was 13.2% and 22.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.40% at a time when SPY gained -1.14%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $183,388 which includes $734 cash and excludes $4,632 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 635.01% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.30% at a time when SPY gained -1.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $180,928 which includes $4,324 cash and excludes $2,450 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 510.57% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -2.49% at a time when SPY gained -1.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $152,642 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 963.59% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.45% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,063,592 which includes $2,118 cash and excludes $15,312 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 206.12% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.38% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $306,124 which includes $192 cash and excludes $14,346 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 436.93% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.28% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $536,925 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 716.92% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.18% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $816,925 which includes $5 cash and excludes $2,271 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 257.96% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.72% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $357,960 which includes $1,667 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 409.66% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.00% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $509,656 which includes $9,637 cash and excludes $14,195 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 176.97% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -1.63% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $276,968 which includes -$776 cash and excludes $15,046 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 297.90% while the benchmark SPY gained 224.86% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.97% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $397,899 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 81.36% while the benchmark SPY gained 68.63% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.17% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $181,358 which includes $2,396 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 26.1%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.65% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $481,846 which includes $1,439 cash and excludes $12,497 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 9.6%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.28% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $33,200 which includes $140,907 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.89% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $306,865 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 21.1%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.89% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $69,793 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 13.1%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.67% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $206,584 which includes $2,544 cash and excludes $8,269 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 21.0%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Since inception, on 7/1/2014, the model gained 244.55% while the benchmark SPY gained 248.72% and VDIGX gained 168.85% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.35% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $344,550 which includes $660 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 9.8%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.30% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $268,606 which includes $1,033 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 19.4%, and for the last 12 months is 21.6%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Since inception, on 6/30/2014, the model gained 246.40% while the benchmark SPY gained 248.72% and the ETF USMV gained 193.15% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.35% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $346,402 which includes $1,694 cash and excludes $8,317 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 24.6%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Since inception, on 1/3/2013, the model gained 888.75% while the benchmark SPY gained 381.38% and the ETF USMV gained 381.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.33% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $988,755 which includes $3,140 cash and excludes $11,758 spent on fees and slippage. |

|

|

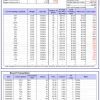

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 8.2%. Over the same period the benchmark BND performance was 2.0% and 8.1% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.44% at a time when BND gained -0.02%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $141,041 which includes $720 cash and excludes $2,671 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.89% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $306,865 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 18.2%, and for the last 12 months is 25.3%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.18% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,472 which includes $462 cash and excludes $4,987 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.96% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,239 which includes -$310 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.89% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $208,641 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 32.4%, and for the last 12 months is 36.9%. Over the same period the benchmark SPY performance was 21.0% and 32.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.18% at a time when SPY gained -1.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $257,414 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.