|

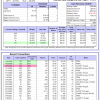

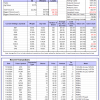

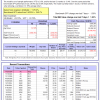

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

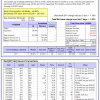

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 2.87% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $125,848,890 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 2.26% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $627,283 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 18.0%. Over the same period the benchmark E60B40 performance was 16.8% and 22.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.58% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $174,815 which includes $772 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 19.8%. Over the same period the benchmark E60B40 performance was 16.8% and 22.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.74% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $183,380 which includes $617 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 15.9%, and for the last 12 months is 21.6%. Over the same period the benchmark E60B40 performance was 16.8% and 22.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.90% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $191,974 which includes $734 cash and excludes $4,632 spent on fees and slippage. |

|

|

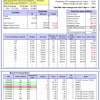

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 697.35% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 4.78% at a time when SPY gained 1.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $196,512 which includes -$1,769 cash and excludes $2,483 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 544.19% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.54% at a time when SPY gained 1.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $154,600 which includes -$3,871 cash and excludes $1,666 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 950.92% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 1.96% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,050,923 which includes $4,638 cash and excludes $15,754 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 218.72% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.72% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $318,719 which includes $428 cash and excludes $14,365 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 477.78% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.12% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $577,782 which includes $2,490 cash and excludes $6,667 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 760.82% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.94% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $860,818 which includes $1,044 cash and excludes $2,271 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 280.95% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 5.78% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $380,952 which includes $957 cash and excludes $2,294 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 407.18% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 3.49% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $507,183 which includes $1,115 cash and excludes $14,915 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 193.69% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.73% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $293,694 which includes $995 cash and excludes $15,306 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 323.00% while the benchmark SPY gained 240.66% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.76% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $422,998 which includes $1,352 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 89.44% while the benchmark SPY gained 76.84% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.27% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $189,444 which includes $1,093 cash and excludes $00 spent on fees and slippage. |

|

|

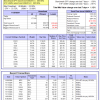

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 29.6%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.73% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $509,604 which includes $2,661 cash and excludes $12,497 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.53% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $16 which includes $140,956 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 19.9%, and for the last 12 months is 26.4%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.59% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $321,723 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 27.0%, and for the last 12 months is 23.3%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.59% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $73,175 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 16.9%, and for the last 12 months is 19.5%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.49% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $213,350 which includes $5,535 cash and excludes $8,272 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 22.1%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Since inception, on 7/1/2014, the model gained 261.25% while the benchmark SPY gained 265.68% and VDIGX gained 176.73% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.30% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $361,254 which includes $677 cash and excludes $5,243 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.49% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $294,157 which includes $1,561 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 21.7%, and for the last 12 months is 24.7%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Since inception, on 6/30/2014, the model gained 252.84% while the benchmark SPY gained 265.68% and the ETF USMV gained 205.99% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.12% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $352,842 which includes $183 cash and excludes $8,350 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 23.2%, and for the last 12 months is 28.7%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Since inception, on 1/3/2013, the model gained 951.30% while the benchmark SPY gained 404.79% and the ETF USMV gained 404.79% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.35% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,051,298 which includes $10,076 cash and excludes $11,758 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 8.6%. Over the same period the benchmark BND performance was 2.6% and 7.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.16% at a time when BND gained 0.98%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $142,531 which includes -$140 cash and excludes $2,730 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 19.9%, and for the last 12 months is 26.4%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.59% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $321,723 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 22.2%, and for the last 12 months is 26.1%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.40% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,503 which includes $66 cash and excludes $4,988 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 19.8%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.27% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $183,094 which includes -$311 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 16.0%, and for the last 12 months is 22.1%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.59% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $218,731 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 26.9%, and for the last 12 months is 30.8%. Over the same period the benchmark SPY performance was 26.9% and 33.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.59% at a time when SPY gained 1.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $246,894 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.