|

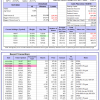

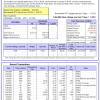

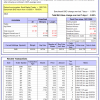

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

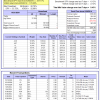

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is -10.8%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -0.32% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $122,121,113 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.52% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $609,643 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 19.8%. Over the same period the benchmark E60B40 performance was 15.0% and 28.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.36% at a time when SPY gained -0.30%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $171,307 which includes $717 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 11.7%, and for the last 12 months is 21.2%. Over the same period the benchmark E60B40 performance was 15.0% and 28.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.30% at a time when SPY gained -0.30%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $179,078 which includes $574 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 22.5%. Over the same period the benchmark E60B40 performance was 15.0% and 28.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.24% at a time when SPY gained -0.30%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $186,825 which includes $704 cash and excludes $4,632 spent on fees and slippage. |

|

|

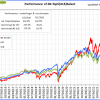

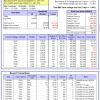

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 655.02% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.88% at a time when SPY gained -0.12%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $185,931 which includes $6,658 cash and excludes $2,447 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 519.79% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.12% at a time when SPY gained -0.12%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $154,947 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 978.07% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -5.20% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,078,069 which includes $2,118 cash and excludes $15,312 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 213.84% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.17% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $313,838 which includes $495 cash and excludes $14,326 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 457.78% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.44% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $557,782 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 723.65% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.75% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $823,650 which includes $8,303 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 262.91% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.20% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $362,910 which includes $1,537 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 418.57% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.97% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $518,565 which includes $9,637 cash and excludes $14,195 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 183.26% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.93% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $283,259 which includes $332 cash and excludes $14,917 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 306.81% while the benchmark SPY gained 232.73% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.82% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $406,814 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 82.63% while the benchmark SPY gained 72.72% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.33% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $182,628 which includes $488 cash and excludes $00 spent on fees and slippage. |

|

|

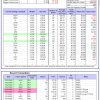

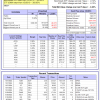

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 32.7%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.10% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $500,446 which includes $2,109 cash and excludes $12,278 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 38.6%, and for the last 12 months is 49.3%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 5.02% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $25 which includes $137,198 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 27.7%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.12% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $314,272 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 24.0%, and for the last 12 months is 12.3%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.12% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $71,479 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.46% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $211,337 which includes $2,344 cash and excludes $8,269 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 30.3%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Since inception, on 7/1/2014, the model gained 259.38% while the benchmark SPY gained 257.17% and VDIGX gained 179.26% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.43% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $359,382 which includes $660 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.87% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $266,454 which includes $3,322 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 18.7%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Since inception, on 6/30/2014, the model gained 244.11% while the benchmark SPY gained 257.17% and the ETF USMV gained 201.33% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.44% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $344,113 which includes $1,694 cash and excludes $8,317 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 18.9%, and for the last 12 months is 28.3%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Since inception, on 1/3/2013, the model gained 914.99% while the benchmark SPY gained 393.05% and the ETF USMV gained 393.05% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -3.26% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,014,993 which includes $3,140 cash and excludes $11,758 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 11.6%. Over the same period the benchmark BND performance was 2.4% and 11.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.88% at a time when BND gained -0.58%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $141,798 which includes $66 cash and excludes $2,671 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 27.7%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.12% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $314,272 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

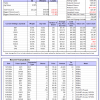

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 20.7%, and for the last 12 months is 31.0%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.35% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,264 which includes $462 cash and excludes $4,987 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 27.6%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.16% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $183,057 which includes $37 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 23.3%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.12% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $213,672 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 31.5%, and for the last 12 months is 37.0%. Over the same period the benchmark SPY performance was 23.9% and 40.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.53% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $255,798 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.