|

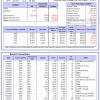

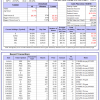

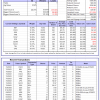

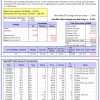

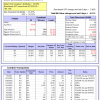

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

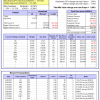

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -14.5%, and for the last 12 months is -18.5%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 4.21% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $132,323,956 which includes $1,658,768 cash and excludes $2,430,028 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.02% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $497,618 which includes $44 cash and excludes $566 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 2.7%. Over the same period the benchmark E60B40 performance was 10.9% and 10.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.11% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $149,276 which includes $498 cash and excludes $3,255 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 3.3%. Over the same period the benchmark E60B40 performance was 10.9% and 10.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.11% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $154,251 which includes $317 cash and excludes $3,432 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 6.9%, and for the last 12 months is 3.8%. Over the same period the benchmark E60B40 performance was 10.9% and 10.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.11% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $159,095 which includes $306 cash and excludes $3,600 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 372.90% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.83% at a time when SPY gained 2.86%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $118,226 which includes $188 cash and excludes $2,031 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 285.58% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.27% at a time when SPY gained 2.86%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $96,395 which includes -$40 cash and excludes $1,284 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 647.53% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 4.18% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $747,526 which includes $2,940 cash and excludes $10,292 spent on fees and slippage. |

|

|

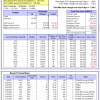

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 160.02% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.35% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $260,020 which includes $880 cash and excludes $10,609 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 340.04% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 3.45% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $440,038 which includes $3,067 cash and excludes $5,757 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 484.43% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.85% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $584,428 which includes $2,081 cash and excludes $1,799 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 172.88% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.26% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $272,878 which includes $1,008 cash and excludes $1,992 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 337.34% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.23% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $437,340 which includes -$3,742 cash and excludes $10,620 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 125.98% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.33% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $225,976 which includes $7,704 cash and excludes $11,848 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 224.61% while the benchmark SPY gained 148.76% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 2.00% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $324,614 which includes $1,261 cash and excludes $5,408 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 39.39% while the benchmark SPY gained 29.13% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 2.67% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $139,389 which includes $2,302 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 11.7%, and for the last 12 months is 21.1%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.75% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $405,628 which includes $1,625 cash and excludes $10,034 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.0%, and for the last 12 months is -10.3%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -4.93% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $120,826 cash and excludes Gain to date spent on fees and slippage. |

|

|

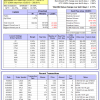

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 8.0%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.19% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $261,823 which includes -$121 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -11.6%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.54% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $59,176 which includes $1,449 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 2.8%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.03% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $175,501 which includes $919 cash and excludes $8,069 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of iM-Combo5 gained -0.51% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $152,908 which includes -$189 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 9.1%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Since inception, on 7/1/2014, the model gained 193.90% while the benchmark SPY gained 167.03% and VDIGX gained 141.09% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.88% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $293,899 which includes $1,359 cash and excludes $4,484 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.44% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $228,532 which includes $5,355 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Since inception, on 6/30/2014, the model gained 182.91% while the benchmark SPY gained 167.03% and the ETF USMV gained 136.46% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.48% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $282,913 which includes $1,508 cash and excludes $7,819 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 27.3%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Since inception, on 1/3/2013, the model gained 663.40% while the benchmark SPY gained 268.61% and the ETF USMV gained 268.61% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.11% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $763,404 which includes $2,652 cash and excludes $8,478 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 1.8%. Over the same period the benchmark BND performance was 2.1% and -1.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.17% at a time when BND gained -0.57%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $134,962 which includes $2,647 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 8.0%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.19% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $261,823 which includes -$121 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.45% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $152,768 which includes $568 cash and excludes $3,709 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 2.7%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.14% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,428 which includes $1,701 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 3.5%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.19% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,376 which includes $439 cash and excludes $5,764 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 4.8%. Over the same period the benchmark SPY performance was 16.9% and 18.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.02% at a time when SPY gained 2.86%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $181,506 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.