|

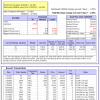

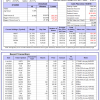

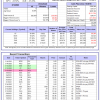

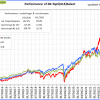

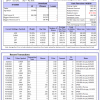

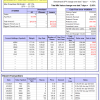

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

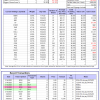

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -16.6%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -7.97% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $129,036,117 which includes -$693,391 cash and excludes $2,179,079 spent on fees and slippage. |

|

|

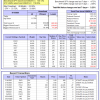

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is -6.5%. Over the same period the benchmark E60B40 performance was 1.5% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.66% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $140,100 which includes $691 cash and excludes $2,960 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -1.1%, and for the last 12 months is -6.2%. Over the same period the benchmark E60B40 performance was 1.5% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -3.32% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $143,362 which includes $772 cash and excludes $3,126 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is -6.0%. Over the same period the benchmark E60B40 performance was 1.5% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.98% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $146,433 which includes $956 cash and excludes $3,285 spent on fees and slippage. |

|

|

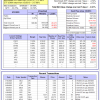

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 278.68% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -6.00% at a time when SPY gained -4.72%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $94,669 which includes -$5,319 cash and excludes $1,904 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 179.91% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.99% at a time when SPY gained -4.72%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $69,977 which includes $329 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 490.22% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.85% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $590,217 which includes $1,908 cash and excludes $9,482 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 162.03% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -10.34% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,029 which includes $1,259 cash and excludes $9,826 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 302.64% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.82% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $402,641 which includes $2,830 cash and excludes $5,411 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 392.55% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -5.71% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $492,552 which includes $1,190 cash and excludes $1,749 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 162.78% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.22% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,777 which includes $552 cash and excludes $1,744 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 368.30% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -3.79% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $468,302 which includes -$6,514 cash and excludes $9,576 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 117.82% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.40% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $217,820 which includes $3,006 cash and excludes $11,434 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 187.87% while the benchmark SPY gained 114.39% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -5.03% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,866 which includes $2,578 cash and excludes $5,274 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 22.43% while the benchmark SPY gained 11.29% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -5.20% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $122,426 which includes $1,532 cash and excludes $00 spent on fees and slippage. |

|

|

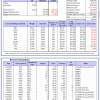

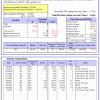

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -4.7%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -4.31% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $376,030 which includes $962 cash and excludes $9,525 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -0.7%, and for the last 12 months is -41.1%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 11.51% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $04 which includes $120,799 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 3.66% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $260,423 which includes $2,622 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -12.5%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 5.22% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $67,137 which includes $213 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 5.3%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 4.73% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $188,624 which includes -$177 cash and excludes $8,064 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 2.3%, and for the last 12 months is -15.7%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of iM-Combo5 gained 2.11% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $156,841 which includes $602 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.6%, and for the last 12 months is -3.0%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Since inception, on 7/1/2014, the model gained 170.05% while the benchmark SPY gained 130.13% and VDIGX gained 124.95% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.71% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $270,051 which includes $749 cash and excludes $4,463 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 3.1%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.95% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $219,629 which includes $2,033 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -4.5%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Since inception, on 6/30/2014, the model gained 156.85% while the benchmark SPY gained 130.13% and the ETF USMV gained 119.09% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.23% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $256,849 which includes $328 cash and excludes $7,737 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Since inception, on 1/3/2013, the model gained 582.73% while the benchmark SPY gained 217.68% and the ETF USMV gained 217.68% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -3.91% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $682,729 which includes $3,060 cash and excludes $7,146 spent on fees and slippage. |

|

|

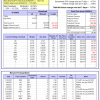

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.3%, and for the last 12 months is -4.3%. Over the same period the benchmark BND performance was 2.4% and -6.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 3.66% at a time when BND gained 2.15%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $137,254 which includes $1,409 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 3.66% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $260,423 which includes $2,622 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 0.3%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.45% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,141 which includes $67 cash and excludes $2,823 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is -5.5%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -2.58% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,228 which includes $603 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -1.3%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -4.69% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $167,900 which includes $1,424 cash and excludes $5,393 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is -5.0%. Over the same period the benchmark SPY performance was 0.8% and -6.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 3.63% at a time when SPY gained -4.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,896 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.