|

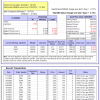

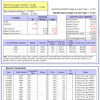

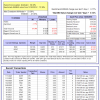

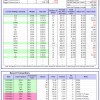

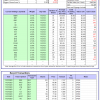

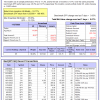

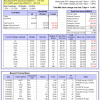

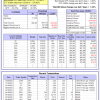

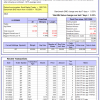

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -19.0%, and for the last 12 months is -16.7%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 0.36% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $125,375,493 which includes $421,630 cash and excludes $2,691,375 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 1.85% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $520,758 which includes $44 cash and excludes $566 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 4.3%. Over the same period the benchmark E60B40 performance was 12.5% and 9.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.14% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,536 which includes $2,002 cash and excludes $3,255 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 4.8%. Over the same period the benchmark E60B40 performance was 12.5% and 9.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.14% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $153,484 which includes $1,874 cash and excludes $3,432 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 5.3%. Over the same period the benchmark E60B40 performance was 12.5% and 9.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.14% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $158,304 which includes $1,912 cash and excludes $3,600 spent on fees and slippage. |

|

|

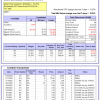

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 408.88% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.53% at a time when SPY gained 0.05%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $127,220 which includes $6,446 cash and excludes $2,201 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 321.04% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.24% at a time when SPY gained 0.05%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $105,260 which includes $91 cash and excludes $1,352 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 721.11% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.28% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $821,106 which includes $2,135 cash and excludes $10,658 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 179.70% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.00% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $279,696 which includes $184 cash and excludes $11,757 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 348.68% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.24% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $448,683 which includes $2,340 cash and excludes $6,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 518.48% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.54% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $618,476 which includes -$297 cash and excludes $2,039 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 165.37% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.52% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $265,366 which includes $1,208 cash and excludes $2,013 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 272.32% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.81% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $372,316 which includes -$7,538 cash and excludes $12,093 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 117.61% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.36% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $217,611 which includes $829 cash and excludes $12,825 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 233.37% while the benchmark SPY gained 155.65% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.88% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $333,369 which includes -$488 cash and excludes $5,993 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 42.84% while the benchmark SPY gained 32.71% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.67% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $142,844 which includes $2,469 cash and excludes $00 spent on fees and slippage. |

|

|

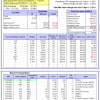

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 6.9%, and for the last 12 months is 3.7%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.37% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $388,265 which includes $2,836 cash and excludes $10,558 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 3.1%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 4.43% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $129,668 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.33% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,338 which includes $2,530 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -11.2%, and for the last 12 months is -6.7%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.07% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $59,428 which includes $714 cash and excludes $2,439 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is -0.8%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.06% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $179,025 which includes $442 cash and excludes $8,103 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 1.1%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of iM-Combo5 gained 0.09% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $153,248 which includes $2,775 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 1.4%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Since inception, on 7/1/2014, the model gained 194.59% while the benchmark SPY gained 174.43% and VDIGX gained 141.36% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.21% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $294,588 which includes $722 cash and excludes $4,770 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.20% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $245,385 which includes $1,488 cash and excludes $3,100 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 7.5%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Since inception, on 6/30/2014, the model gained 181.72% while the benchmark SPY gained 174.43% and the ETF USMV gained 142.53% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.19% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $281,719 which includes $184 cash and excludes $7,980 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 16.0%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Since inception, on 1/3/2013, the model gained 712.38% while the benchmark SPY gained 278.82% and the ETF USMV gained 278.82% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.03% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $812,375 which includes $2,898 cash and excludes $8,998 spent on fees and slippage. |

|

|

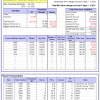

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.6%, and for the last 12 months is -1.5%. Over the same period the benchmark BND performance was 1.4% and 0.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.32% at a time when BND gained 0.35%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $132,192 which includes $3,986 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.33% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,338 which includes $2,530 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 3.2%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.05% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,910 which includes $68 cash and excludes $4,292 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.82% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $153,144 which includes $471 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 5.1%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.33% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,524 which includes $2,301 cash and excludes $5,764 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 20.2% and 14.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.88% at a time when SPY gained 0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $190,037 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.