|

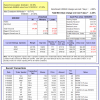

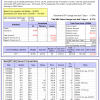

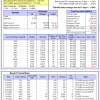

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -16.3%, and for the last 12 months is -12.6%. Over the same period the benchmark E60B40 performance was -19.1% and -15.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.48% at a time when SPY gained -4.86%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $136,358 which includes $394 cash and excludes $2,673 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -16.6%, and for the last 12 months is -12.7%. Over the same period the benchmark E60B40 performance was -19.1% and -15.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -3.48% at a time when SPY gained -4.86%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $140,227 which includes $496 cash and excludes $2,831 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -16.9%, and for the last 12 months is -12.8%. Over the same period the benchmark E60B40 performance was -19.1% and -15.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.48% at a time when SPY gained -4.86%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $143,942 which includes $638 cash and excludes $2,982 spent on fees and slippage. |

|

|

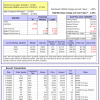

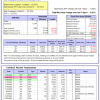

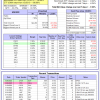

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 275.88% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -8.01% at a time when SPY gained -6.24%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $93,970 which includes $876 cash and excludes $1,778 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 169.79% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -8.06% at a time when SPY gained -6.24%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $67,447 which includes $118 cash and excludes $1,149 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 392.31% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -6.86% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $492,314 which includes $2,160 cash and excludes $9,392 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 113.66% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -11.95% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $213,658 which includes -$2,370 cash and excludes $8,658 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 226.79% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -6.60% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $326,795 which includes $6,515 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 351.49% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -6.61% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $451,488 which includes $3,099 cash and excludes $1,738 spent on fees and slippage. |

|

|

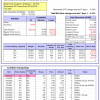

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 150.72% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -4.05% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $250,716 which includes $1,446 cash and excludes $1,702 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 329.21% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -6.88% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $429,209 which includes -$5,844 cash and excludes $8,417 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 123.15% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -7.58% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $223,154 which includes -$971 cash and excludes $10,112 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 140.95% while the benchmark SPY gained 101.75% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -7.79% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $240,954 which includes $3,087 cash and excludes $5,012 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 10.29% while the benchmark SPY gained 4.73% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -6.11% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $110,291 which includes $2,513 cash and excludes $00 spent on fees and slippage. |

|

|

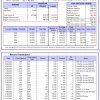

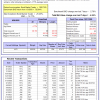

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -19.8%, and for the last 12 months is -19.8%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -6.62% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $323,076 which includes $2,217 cash and excludes $8,571 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -46.8%, and for the last 12 months is -37.0%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -10.32% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $30,773 which includes $118,247 cash and excludes Gain to date spent on fees and slippage. |

|

|

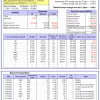

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -20.9%, and for the last 12 months is -21.2%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -6.23% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $232,551 which includes $485 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -30.3%, and for the last 12 months is -25.3%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of Best(SPY-SH) gained -6.21% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $61,840 which includes $272 cash and excludes $2,306 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -13.3%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.91% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,489 which includes -$682 cash and excludes $7,983 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -33.6%, and for the last 12 months is -29.2%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of iM-Combo5 gained -4.10% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $150,762 which includes $1,749 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -20.7%, and for the last 12 months is -15.0%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Since inception, on 7/1/2014, the model gained 153.94% while the benchmark SPY gained 116.57% and VDIGX gained 117.01% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -4.48% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $253,938 which includes $264 cash and excludes $4,365 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -13.5%, and for the last 12 months is -9.0%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -5.75% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $188,093 which includes $4,602 cash and excludes $2,452 spent on fees and slippage. |

|

|

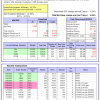

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -10.8%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Since inception, on 6/30/2014, the model gained 127.85% while the benchmark SPY gained 116.57% and the ETF USMV gained 111.24% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -4.54% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $227,849 which includes $2,217 cash and excludes $7,579 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Since inception, on 1/3/2013, the model gained 508.75% while the benchmark SPY gained 198.96% and the ETF USMV gained 198.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -7.00% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $608,751 which includes $865 cash and excludes $6,847 spent on fees and slippage. |

|

|

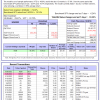

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -15.1%, and for the last 12 months is -15.4%. Over the same period the benchmark BND performance was -14.8% and -15.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -4.24% at a time when BND gained -2.78%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $128,909 which includes $1,746 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -20.9%, and for the last 12 months is -21.2%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -6.23% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $232,551 which includes $485 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -15.9%, and for the last 12 months is -8.9%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -7.14% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,891 which includes $778 cash and excludes $1,686 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -14.1%, and for the last 12 months is -6.1%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -5.69% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $144,683 which includes $434 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -16.7%, and for the last 12 months is -10.6%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -3.24% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $167,670 which includes -$90 cash and excludes $5,043 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -12.9%, and for the last 12 months is -4.8%. Over the same period the benchmark SPY performance was -22.4% and -16.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -3.03% at a time when SPY gained -6.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $155,584 which includes $62 cash and excludes $8,561 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.