|

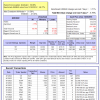

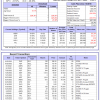

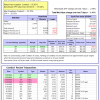

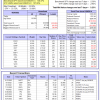

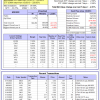

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

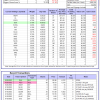

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is -6.3%. Over the same period the benchmark E60B40 performance was -12.6% and -9.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.48% at a time when SPY gained -1.71%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,753 which includes $1,140 cash and excludes $2,392 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -10.3%, and for the last 12 months is -6.3%. Over the same period the benchmark E60B40 performance was -12.6% and -9.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.71% at a time when SPY gained -1.71%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,861 which includes $890 cash and excludes $2,542 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is -6.4%. Over the same period the benchmark E60B40 performance was -12.6% and -9.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.94% at a time when SPY gained -1.71%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $154,796 which includes $781 cash and excludes $2,686 spent on fees and slippage. |

|

|

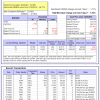

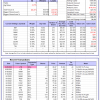

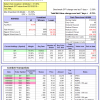

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 327.19% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -2.72% at a time when SPY gained -2.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,798 which includes $850 cash and excludes $1,778 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 209.19% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -2.41% at a time when SPY gained -2.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $77,299 which includes -$924 cash and excludes $1,144 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 459.22% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.74% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $559,225 which includes $1,161 cash and excludes $9,392 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 172.89% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.65% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $272,888 which includes $939 cash and excludes $8,554 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 266.70% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -3.07% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $366,695 which includes $6,011 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 416.36% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.20% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $516,360 which includes $2,714 cash and excludes $1,738 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 171.92% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -2.15% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $271,925 which includes $328 cash and excludes $1,554 spent on fees and slippage. |

|

|

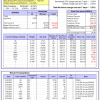

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 351.27% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -3.40% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $451,268 which includes -$3,743 cash and excludes $7,815 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 141.46% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.78% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $241,457 which includes -$1,295 cash and excludes $10,112 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 157.15% while the benchmark SPY gained 122.06% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -3.71% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $257,146 which includes $2,781 cash and excludes $4,891 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 22.13% while the benchmark SPY gained 15.27% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.93% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $122,128 which includes $1,874 cash and excludes $00 spent on fees and slippage. |

|

|

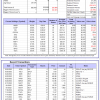

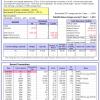

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -10.1%, and for the last 12 months is -11.2%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -2.48% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $361,881 which includes $38,739 cash and excludes $8,439 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -37.4%, and for the last 12 months is -30.7%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.83% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $20,606 which includes $111,827 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -13.0%, and for the last 12 months is -14.2%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.60% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $255,944 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -23.4%, and for the last 12 months is -18.7%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.58% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $68,018 which includes $376 cash and excludes $2,304 spent on fees and slippage. |

|

|

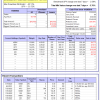

iM-Combo3.R1: The model’s out of sample performance YTD is -11.8%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.41% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $185,646 which includes -$1,035 cash and excludes $7,965 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -28.7%, and for the last 12 months is -24.7%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of iM-Combo5 gained -2.75% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $161,960 which includes -$1,361 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -13.8%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Since inception, on 7/1/2014, the model gained 176.18% while the benchmark SPY gained 138.37% and VDIGX gained 134.56% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.53% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $276,183 which includes $796 cash and excludes $4,357 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is -3.3%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.70% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $205,121 which includes $1,492 cash and excludes $2,452 spent on fees and slippage. |

|

|

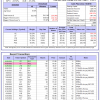

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -8.7%, and for the last 12 months is -7.3%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Since inception, on 6/30/2014, the model gained 139.58% while the benchmark SPY gained 138.37% and the ETF USMV gained 127.00% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.23% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $239,580 which includes $841 cash and excludes $7,579 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 14.7%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Since inception, on 1/3/2013, the model gained 550.90% while the benchmark SPY gained 229.05% and the ETF USMV gained 229.05% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.51% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $650,898 which includes -$4,049 cash and excludes $6,602 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -10.6%, and for the last 12 months is -11.9%. Over the same period the benchmark BND performance was -10.5% and -11.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.73% at a time when BND gained -0.40%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $135,820 which includes $1,093 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -13.0%, and for the last 12 months is -14.2%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.60% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $255,944 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 0.3%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.63% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,305 which includes $1,074 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.5%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.36% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,405 which includes $1,626 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.60% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,098 which includes -$696 cash and excludes $4,688 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -6.8%, and for the last 12 months is -0.1%. Over the same period the benchmark SPY performance was -14.6% and -9.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.16% at a time when SPY gained -2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,523 which includes $93 cash and excludes $8,561 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.