|

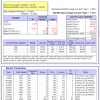

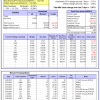

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is -5.2%. Over the same period the benchmark E60B40 performance was -13.0% and -8.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.47% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,729 which includes $2,951 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -10.3%, and for the last 12 months is -5.3%. Over the same period the benchmark E60B40 performance was -13.0% and -8.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.47% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,843 which includes $3,137 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is -5.3%. Over the same period the benchmark E60B40 performance was -13.0% and -8.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.47% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $154,781 which includes $3,259 cash and excludes $2,374 spent on fees and slippage. |

|

|

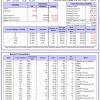

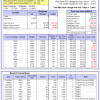

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 308.59% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.75% at a time when SPY gained 3.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $102,148 which includes $26 cash and excludes $1,739 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 216.46% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 12.99% at a time when SPY gained 3.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $79,115 which includes -$315 cash and excludes $1,495 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 457.21% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 5.69% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $557,208 which includes -$4,020 cash and excludes $9,109 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 151.09% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.82% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $251,085 which includes $1,036 cash and excludes $8,408 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 253.89% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 5.61% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $353,891 which includes $4,315 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 423.27% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 5.00% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $523,265 which includes $1,985 cash and excludes $1,738 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 184.09% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.90% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $284,094 which includes $3,064 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 361.63% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 4.99% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $461,631 which includes $4,517 cash and excludes $7,423 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 121.22% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.64% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $221,221 which includes $101 cash and excludes $9,778 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 159.37% while the benchmark SPY gained 118.16% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.49% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $259,371 which includes $1,711 cash and excludes $4,762 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 20.80% while the benchmark SPY gained 13.25% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 4.02% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $120,799 which includes $1,734 cash and excludes $00 spent on fees and slippage. |

|

|

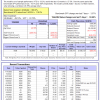

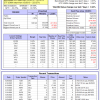

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 4.18% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $361,740 which includes $1,178 cash and excludes $8,218 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -33.2%, and for the last 12 months is -27.5%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -18.65% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $31 which includes $104,278 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -24.7%, and for the last 12 months is -18.2%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 3.52% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $66,850 which includes $790 cash and excludes $2,304 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -15.4%, and for the last 12 months is -7.9%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 5.26% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $178,128 which includes -$356 cash and excludes $7,956 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -28.2%, and for the last 12 months is -22.7%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of iM-Combo5 gained 4.09% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $163,110 which includes $1,391 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -13.8%, and for the last 12 months is -9.9%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Since inception, on 7/1/2014, the model gained 176.15% while the benchmark SPY gained 134.19% and VDIGX gained 132.09% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.97% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $276,153 which includes $399 cash and excludes $4,356 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.86% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $213,266 which includes $772 cash and excludes $2,452 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is -2.3%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Since inception, on 6/30/2014, the model gained 150.13% while the benchmark SPY gained 134.19% and the ETF USMV gained 124.12% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.44% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $250,129 which includes $1,366 cash and excludes $7,530 spent on fees and slippage. |

|

|

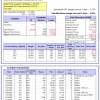

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.6%, and for the last 12 months is 11.1%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Since inception, on 1/3/2013, the model gained 518.19% while the benchmark SPY gained 223.27% and the ETF USMV gained 223.27% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.93% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $618,186 which includes $2,523 cash and excludes $6,594 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -9.4%, and for the last 12 months is -10.7%. Over the same period the benchmark BND performance was -9.0% and -9.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 2.80% at a time when BND gained 1.10%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $137,687 which includes $551 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -7.1%, and for the last 12 months is 0.2%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.95% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $144,636 which includes $1,074 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -8.8%, and for the last 12 months is 0.0%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.86% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $153,639 which includes $1,466 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -11.1%, and for the last 12 months is -3.5%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.21% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,893 which includes -$696 cash and excludes $4,688 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -7.7%, and for the last 12 months is -3.3%. Over the same period the benchmark SPY performance was -16.1% and -8.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.69% at a time when SPY gained 3.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $164,828 which includes $93 cash and excludes $8,561 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.