|

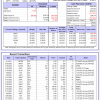

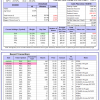

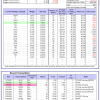

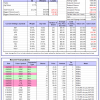

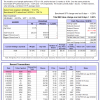

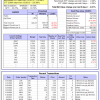

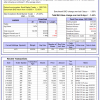

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -9.4%, and for the last 12 months is -1.5%. Over the same period the benchmark E60B40 performance was -11.5% and -4.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.52% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $147,531 which includes $2,330 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -9.8%, and for the last 12 months is -1.3%. Over the same period the benchmark E60B40 performance was -11.5% and -4.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.52% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $151,667 which includes $2,498 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -1.3%. Over the same period the benchmark E60B40 performance was -11.5% and -4.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.52% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,625 which includes $2,604 cash and excludes $2,374 spent on fees and slippage. |

|

|

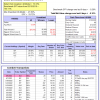

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 327.58% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.83% at a time when SPY gained -0.28%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,896 which includes $991 cash and excludes $1,733 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 194.75% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.37% at a time when SPY gained -0.28%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $73,687 which includes -$234 cash and excludes $1,109 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 485.11% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.02% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $585,111 which includes -$4,871 cash and excludes $8,673 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 195.27% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.15% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,274 which includes $7,050 cash and excludes $8,257 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 275.16% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.10% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $375,162 which includes $2,501 cash and excludes $4,981 spent on fees and slippage. |

|

|

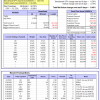

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 436.37% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.02% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $536,911 which includes $3,590 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 190.13% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.66% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $290,130 which includes $1,067 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 363.09% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.22% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $463,091 which includes $327 cash and excludes $7,019 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 141.66% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.49% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $241,656 which includes $1,834 cash and excludes $9,567 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 153.29% while the benchmark SPY gained 126.13% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.77% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $253,287 which includes $749 cash and excludes $4,521 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 26.24% while the benchmark SPY gained 17.39% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.03% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $126,268 which includes $337 cash and excludes $00 spent on fees and slippage. |

|

|

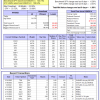

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -5.3%, and for the last 12 months is -8.3%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.34% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $381,441 which includes $3,251 cash and excludes $7,972 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 1.6%, and for the last 12 months is -9.9%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.83% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $12,999 which includes $104,255 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.28% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $266,280 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -12.9%, and for the last 12 months is -1.3%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.28% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $741,180 which includes $370 cash and excludes $25,234 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is 3.2%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.35% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $190,076 which includes $2,208 cash and excludes $7,779 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -23.7%, and for the last 12 months is -12.3%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of iM-Combo5 gained -0.10% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $173,413 which includes $834 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -11.9%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Since inception, on 7/1/2014, the model gained 182.28% while the benchmark SPY gained 142.74% and VDIGX gained 139.56% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.40% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $282,279 which includes $1,078 cash and excludes $4,345 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.59% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $223,102 which includes $2,554 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -1.8%, and for the last 12 months is 0.8%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Since inception, on 6/30/2014, the model gained 157.48% while the benchmark SPY gained 142.74% and the ETF USMV gained 128.04% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.89% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $257,478 which includes $1,998 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 12.9%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Since inception, on 1/3/2013, the model gained 531.06% while the benchmark SPY gained 235.08% and the ETF USMV gained 235.08% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.61% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $631,063 which includes $1,830 cash and excludes $6,473 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -8.1%, and for the last 12 months is -7.7%. Over the same period the benchmark BND performance was -9.8% and -9.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.44% at a time when BND gained -1.09%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $139,544 which includes $537 cash and excludes $2,263 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.28% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $266,280 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.64% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,652 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.62% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,981 which includes $556 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.9%, and for the last 12 months is -1.3%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.34% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,364 which includes $1,914 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.1%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was -13.0% and -1.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.36% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,668 which includes $63 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.