|

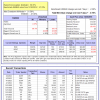

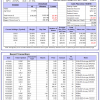

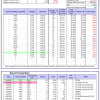

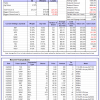

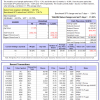

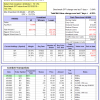

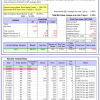

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

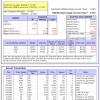

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -2.1%. Over the same period the benchmark E60B40 performance was -13.4% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.78% at a time when SPY gained -2.39%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,207 which includes $1,611 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -10.6%, and for the last 12 months is -1.9%. Over the same period the benchmark E60B40 performance was -13.4% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.78% at a time when SPY gained -2.39%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,307 which includes $1,759 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -11.0%, and for the last 12 months is -1.9%. Over the same period the benchmark E60B40 performance was -13.4% and -6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.78% at a time when SPY gained -2.39%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $154,231 which includes $1,846 cash and excludes $2,374 spent on fees and slippage. |

|

|

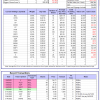

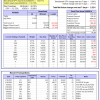

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 297.58% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -11.95% at a time when SPY gained -3.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $99,394 which includes -$1,192 cash and excludes $1,653 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 185.25% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -12.55% at a time when SPY gained -3.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $69,578 which includes -$1,475 cash and excludes $1,059 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 441.27% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -4.73% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $541,272 which includes $1,130 cash and excludes $8,445 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 182.08% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -4.23% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $282,084 which includes $4,017 cash and excludes $8,132 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 268.15% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.72% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $368,152 which includes $1,210 cash and excludes $4,981 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 417.79% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -4.88% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $517,789 which includes $2,838 cash and excludes $1,706 spent on fees and slippage. |

|

|

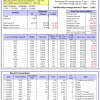

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 184.46% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.08% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $284,455 which includes $769 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 351.50% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.33% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $451,501 which includes -$6,442 cash and excludes $6,856 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 129.46% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.80% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $229,458 which includes $645 cash and excludes $9,233 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 174.92% while the benchmark SPY gained 118.65% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -4.21% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $274,923 which includes -$415 cash and excludes $4,315 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 20.76% while the benchmark SPY gained 13.50% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.42% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $120,762 which includes $442 cash and excludes $00 spent on fees and slippage. |

|

|

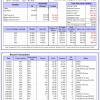

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is -9.0%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -2.13% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $379,948 which includes $709 cash and excludes $7,957 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -1.3%, and for the last 12 months is -10.9%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -11.03% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $25,116 which includes $100,120 cash and excludes Gain to date spent on fees and slippage. |

|

|

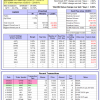

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.5%, and for the last 12 months is -12.0%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.93% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $257,481 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -15.8%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.93% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $716,678 which includes $370 cash and excludes $25,134 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.35% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,861 which includes $61,828 cash and excludes $7,776 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -25.1%, and for the last 12 months is -13.7%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of iM-Combo5 gained -4.29% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $170,138 which includes $34,647 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -14.4%, and for the last 12 months is -9.3%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Since inception, on 7/1/2014, the model gained 174.28% while the benchmark SPY gained 134.71% and VDIGX gained 133.15% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.22% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $274,276 which includes $211 cash and excludes $4,336 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.04% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $228,416 which includes $1,808 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -3.1%, and for the last 12 months is -0.6%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Since inception, on 6/30/2014, the model gained 154.08% while the benchmark SPY gained 134.71% and the ETF USMV gained 122.35% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.00% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $254,079 which includes $1,829 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.3%, and for the last 12 months is 10.5%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Since inception, on 1/3/2013, the model gained 510.60% while the benchmark SPY gained 224.01% and the ETF USMV gained 224.01% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.60% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $610,596 which includes $6,154 cash and excludes $6,351 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -10.0%, and for the last 12 months is -9.3%. Over the same period the benchmark BND performance was -10.1% and -9.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.92% at a time when BND gained -0.09%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,718 which includes -$10 cash and excludes $2,263 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.5%, and for the last 12 months is -12.0%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.93% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $257,481 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.20% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,709 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is 2.8%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.49% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $155,925 which includes $404 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.9%, and for the last 12 months is -1.2%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.08% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,229 which includes $1,693 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was -15.9% and -4.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.45% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $177,832 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.