|

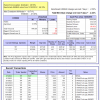

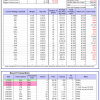

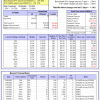

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

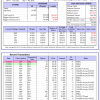

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -8.2%, and for the last 12 months is 7.0%. Over the same period the benchmark E60B40 performance was -8.4% and 5.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.42% at a time when SPY gained -2.52%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $149,550 which includes $93 cash and excludes $1,787 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -9.3%, and for the last 12 months is 7.0%. Over the same period the benchmark E60B40 performance was -8.4% and 5.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.93% at a time when SPY gained -2.52%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $152,539 which includes $1,038 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.3%, and for the last 12 months is 6.8%. Over the same period the benchmark E60B40 performance was -8.4% and 5.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.43% at a time when SPY gained -2.52%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,371 which includes $670 cash and excludes $2,048 spent on fees and slippage. |

|

|

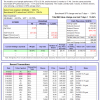

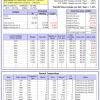

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 346.49% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -8.54% at a time when SPY gained -3.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $111,622 which includes -$2,475 cash and excludes $1,636 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 225.31% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -10.82% at a time when SPY gained -3.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $81,327 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 465.74% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -8.05% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $565,744 which includes $798 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 154.72% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.75% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $254,716 which includes $1,607 cash and excludes $7,609 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 284.21% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.81% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $384,214 which includes $1,960 cash and excludes $4,350 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 464.56% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -5.54% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $564,561 which includes $1,016 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 169.99% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.87% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $269,993 which includes $350 cash and excludes $1,532 spent on fees and slippage. |

|

|

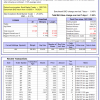

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 377.55% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.43% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $477,552 which includes $71 cash and excludes $6,430 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 121.98% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 4.50% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $221,983 which includes $398 cash and excludes $8,862 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 188.39% while the benchmark SPY gained 129.62% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -4.65% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $288,389 which includes $1,756 cash and excludes $3,948 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 22.45% while the benchmark SPY gained 19.19% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.41% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $122,449 which includes $1,781 cash and excludes $00 spent on fees and slippage. |

|

|

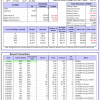

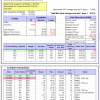

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 7.4%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.15% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $392,550 which includes $2,108 cash and excludes $7,640 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 25.3%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 15.24% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $20,428 which includes $90,795 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.95% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $270,333 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

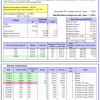

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -11.6%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.94% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $752,436 which includes $398 cash and excludes $25,132 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -15.0%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -5.90% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $179,000 which includes $4,874 cash and excludes $7,707 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -17.9%, and for the last 12 months is 2.7%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of iM-Combo5 gained -6.51% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $186,505 which includes $802 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -13.9%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Since inception, on 7/1/2014, the model gained 175.83% while the benchmark SPY gained 146.48% and VDIGX gained 143.43% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.69% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $275,835 which includes -$398 cash and excludes $4,274 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 16.9%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.23% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $218,464 which includes $1,722 cash and excludes $2,171 spent on fees and slippage. |

|

|

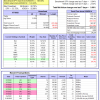

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Since inception, on 6/30/2014, the model gained 154.84% while the benchmark SPY gained 146.48% and the ETF USMV gained 130.17% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.18% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $254,842 which includes $354 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 20.6%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Since inception, on 1/3/2013, the model gained 486.46% while the benchmark SPY gained 240.25% and the ETF USMV gained 240.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.40% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $586,459 which includes $7,878 cash and excludes $5,344 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -4.6%, and for the last 12 months is -2.5%. Over the same period the benchmark BND performance was -3.6% and -2.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.96% at a time when BND gained -0.40%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $144,967 which includes -$81 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.95% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $270,333 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is 15.0%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.05% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,596 which includes $108 cash and excludes $1,391 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 17.0%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.50% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,627 which includes -$549 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -11.5%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -3.86% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,122 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 28.2%. Over the same period the benchmark SPY performance was -11.7% and 10.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 4.56% at a time when SPY gained -3.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $191,865 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.