|

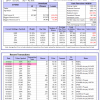

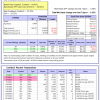

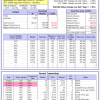

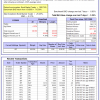

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is 8.1%. Over the same period the benchmark E60B40 performance was -4.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.99% at a time when SPY gained -0.69%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $153,748 which includes $1,538 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.9%, and for the last 12 months is 9.1%. Over the same period the benchmark E60B40 performance was -4.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.89% at a time when SPY gained -0.69%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $158,297 which includes $963 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is 10.0%. Over the same period the benchmark E60B40 performance was -4.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.79% at a time when SPY gained -0.69%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $162,703 which includes $618 cash and excludes $2,048 spent on fees and slippage. |

|

|

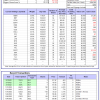

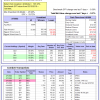

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 400.25% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.50% at a time when SPY gained -0.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $125,062 which includes -$3,271 cash and excludes $1,577 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 274.61% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -7.05% at a time when SPY gained -0.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $93,652 which includes $79 cash and excludes $998 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 532.72% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.97% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $632,720 which includes $1,819 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 147.02% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.63% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $247,016 which includes $719 cash and excludes $7,276 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 282.34% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.09% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $382,340 which includes $500 cash and excludes $4,167 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 512.56% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.15% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $612,555 which includes $3,059 cash and excludes $1,675 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 191.06% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.90% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $291,061 which includes $2,114 cash and excludes $1,529 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 395.60% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.89% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $495,598 which includes $1,020 cash and excludes $6,397 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 115.30% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -1.01% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $215,300 which includes $474 cash and excludes $8,576 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 216.05% while the benchmark SPY gained 144.85% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -2.40% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $316,052 which includes $5,471 cash and excludes $3,666 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.96% while the benchmark SPY gained 27.10% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.04% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $124,956 which includes -$236 cash and excludes $00 spent on fees and slippage. |

|

|

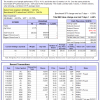

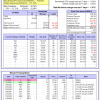

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.80% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $392,550 which includes $793 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -4.1%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 4.48% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$21,135 which includes $81,539 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.1%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.08% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $284,875 which includes $4,798 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.59% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $802,235 which includes $2,981 cash and excludes $25,129 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -7.7%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.05% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,421 which includes $5,334 cash and excludes $7,577 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -9.6%, and for the last 12 months is 11.4%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of iM-Combo5 gained -1.87% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $205,320 which includes $2,735 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 199.75% while the benchmark SPY gained 162.84% and VDIGX gained 151.57% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.47% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $299,750 which includes $319 cash and excludes $4,184 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.93% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $219,947 which includes $423 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Since inception, on 6/30/2014, the model gained 161.59% while the benchmark SPY gained 162.84% and the ETF USMV gained 135.17% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.43% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $261,594 which includes $115 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 30.2%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Since inception, on 1/3/2013, the model gained 489.84% while the benchmark SPY gained 262.82% and the ETF USMV gained 262.82% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.83% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $589,838 which includes $6,219 cash and excludes $5,344 spent on fees and slippage. |

|

|

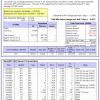

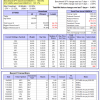

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -3.2%, and for the last 12 months is -1.7%. Over the same period the benchmark BND performance was -2.9% and -3.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.09% at a time when BND gained -0.85%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $147,085 which includes $706 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.1%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.08% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $284,875 which includes $4,798 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.9%, and for the last 12 months is 15.6%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.20% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,634 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is 16.9%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.55% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,635 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 16.7%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.58% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $189,699 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 10.1%. Over the same period the benchmark SPY performance was -5.8% and 16.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.26% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $174,987 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.