|

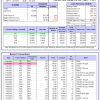

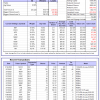

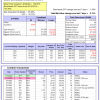

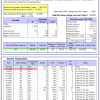

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

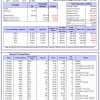

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -6.6%, and for the last 12 months is 5.9%. Over the same period the benchmark E60B40 performance was -6.1% and 6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.01% at a time when SPY gained -1.53%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $152,198 which includes $1,538 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 6.6%. Over the same period the benchmark E60B40 performance was -6.1% and 6.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.13% at a time when SPY gained -1.53%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $156,503 which includes $963 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is 7.2%. Over the same period the benchmark E60B40 performance was -6.1% and 6.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.25% at a time when SPY gained -1.53%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $160,667 which includes $618 cash and excludes $2,048 spent on fees and slippage. |

|

|

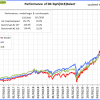

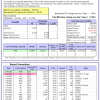

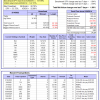

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 390.35% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.98% at a time when SPY gained -1.84%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $122,586 which includes -$2,561 cash and excludes $1,582 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 264.00% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -2.83% at a time when SPY gained -1.84%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $90,999 which includes $79 cash and excludes $998 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 515.38% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.74% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $615,377 which includes $588 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 153.38% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.58% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $253,383 which includes $177 cash and excludes $7,387 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 279.97% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.62% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $379,973 which includes $915 cash and excludes $4,167 spent on fees and slippage. |

|

|

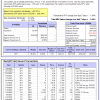

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 510.48% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.34% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $610,475 which includes $472 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 189.16% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.65% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $289,156 which includes $2,114 cash and excludes $1,529 spent on fees and slippage. |

|

|

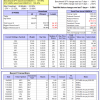

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 381.87% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.77% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $481,873 which includes $1,020 cash and excludes $6,397 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 108.45% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -3.18% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $208,450 which includes $3,111 cash and excludes $8,671 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 216.96% while the benchmark SPY gained 140.34% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.29% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $316,957 which includes $334 cash and excludes $3,672 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.83% while the benchmark SPY gained 24.76% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.10% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $124,833 which includes $920 cash and excludes $00 spent on fees and slippage. |

|

|

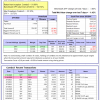

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -2.7%, and for the last 12 months is 7.0%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.23% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $391,659 which includes $1,423 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 10.28% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $60,157 which includes $85,828 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.66% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $282,988 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

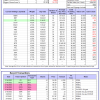

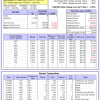

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.84% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $787,510 which includes $2,981 cash and excludes $25,129 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -9.0%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.42% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $191,658 which includes $6,842 cash and excludes $7,705 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -11.5%, and for the last 12 months is 7.5%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of iM-Combo5 gained -2.13% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $200,955 which includes $4,077 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Since inception, on 7/1/2014, the model gained 194.17% while the benchmark SPY gained 157.99% and VDIGX gained 147.57% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.86% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $294,168 which includes $489 cash and excludes $4,184 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.45% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $218,963 which includes $738 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Since inception, on 6/30/2014, the model gained 160.29% while the benchmark SPY gained 157.99% and the ETF USMV gained 130.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.50% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $260,289 which includes $115 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 24.4%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Since inception, on 1/3/2013, the model gained 477.91% while the benchmark SPY gained 256.13% and the ETF USMV gained 256.13% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.02% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $578,155 which includes $6,758 cash and excludes $5,344 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -3.9%, and for the last 12 months is -2.7%. Over the same period the benchmark BND performance was -3.9% and -4.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.71% at a time when BND gained -1.08%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $146,036 which includes -$650 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.66% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $282,988 which includes -$619 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.4%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.61% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,219 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 14.1%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.67% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,955 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.81% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,271 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 12.5%. Over the same period the benchmark SPY performance was -7.6% and 13.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.72% at a time when SPY gained -1.84%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,744 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.