|

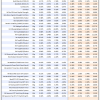

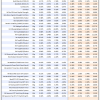

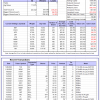

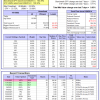

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

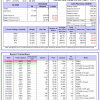

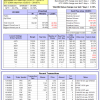

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -4.7%, and for the last 12 months is 12.6%. Over the same period the benchmark E60B40 performance was -4.0% and 12.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.36% at a time when SPY gained 1.25%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $155,280 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.0%, and for the last 12 months is 14.1%. Over the same period the benchmark E60B40 performance was -4.0% and 12.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.53% at a time when SPY gained 1.25%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $159,711 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -5.4%, and for the last 12 months is 15.5%. Over the same period the benchmark E60B40 performance was -4.0% and 12.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.69% at a time when SPY gained 1.25%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $163,993 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

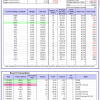

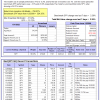

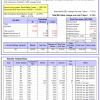

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 397.76% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 4.56% at a time when SPY gained 2.29%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $124,439 which includes -$3,271 cash and excludes $1,577 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 303.00% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.19% at a time when SPY gained 2.29%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $100,751 which includes $79 cash and excludes $998 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 552.11% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.88% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $652,114 which includes $1,622 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 143.06% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 5.69% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $243,065 which includes $719 cash and excludes $7,276 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 286.54% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.27% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $386,544 which includes $2,616 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 505.58% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.95% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $605,579 which includes $3,059 cash and excludes $1,675 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 196.70% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.06% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $296,696 which includes $2,114 cash and excludes $1,529 spent on fees and slippage. |

|

|

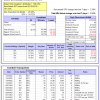

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 386.42% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.57% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $486,416 which includes $1,020 cash and excludes $6,397 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 117.50% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.17% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $217,502 which includes $474 cash and excludes $8,576 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 223.82% while the benchmark SPY gained 146.30% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.84% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $323,819 which includes $5,471 cash and excludes $3,666 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.91% while the benchmark SPY gained 27.86% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.51% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $124,910 which includes $2,101 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 15.2%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.89% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $395,718 which includes $3,367 cash and excludes $7,395 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -8.2%, and for the last 12 months is 12.9%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -3.39% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$21,135 which includes $81,539 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 12.4%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.19% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,977 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.28% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $806,970 which includes $2,981 cash and excludes $25,129 spent on fees and slippage. |

|

|

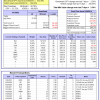

iM-Combo3.R1: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.52% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $196,479 which includes $4,878 cash and excludes $7,447 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is 18.4%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of iM-Combo5 gained 1.31% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $209,238 which includes $4,332 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -5.0%, and for the last 12 months is 15.9%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Since inception, on 7/1/2014, the model gained 204.21% while the benchmark SPY gained 164.39% and VDIGX gained 152.64% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.34% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $304,210 which includes $1,364 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.39% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $224,284 which includes $423 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Since inception, on 6/30/2014, the model gained 162.72% while the benchmark SPY gained 164.39% and the ETF USMV gained 136.32% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.83% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $262,716 which includes -$52 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 33.6%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Since inception, on 1/3/2013, the model gained 479.21% while the benchmark SPY gained 264.97% and the ETF USMV gained 264.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.15% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $579,214 which includes $490 cash and excludes $5,308 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 0.4%. Over the same period the benchmark BND performance was -2.1% and -3.1% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.19% at a time when BND gained -0.31%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $148,706 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 12.4%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.19% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,977 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.7%, and for the last 12 months is 18.7%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.51% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,930 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.1%, and for the last 12 months is 21.8%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.75% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $161,519 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 22.9%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.24% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $190,801 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -3.2%, and for the last 12 months is 7.1%. Over the same period the benchmark SPY performance was -5.3% and 23.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -2.30% at a time when SPY gained 2.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $172,812 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.