|

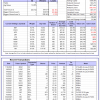

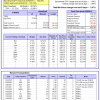

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

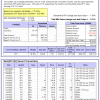

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is 12.6%. Over the same period the benchmark E60B40 performance was -3.3% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.74% at a time when SPY gained -1.49%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $156,362 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -4.1%, and for the last 12 months is 14.1%. Over the same period the benchmark E60B40 performance was -3.3% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.87% at a time when SPY gained -1.49%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $161,188 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 15.5%. Over the same period the benchmark E60B40 performance was -3.3% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.99% at a time when SPY gained -1.49%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $165,870 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

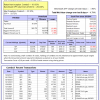

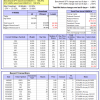

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 396.03% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -4.24% at a time when SPY gained -1.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $124,008 which includes -$3,271 cash and excludes $1,577 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 318.10% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -4.93% at a time when SPY gained -1.94%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $104,525 which includes $79 cash and excludes $998 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 586.40% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.11% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $686,397 which includes $796 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 145.41% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.54% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $245,415 which includes $576 cash and excludes $7,164 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 298.73% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.90% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $398,727 which includes $2,616 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 537.37% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.06% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $637,374 which includes $3,059 cash and excludes $1,675 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 200.37% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.73% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $300,367 which includes $1,798 cash and excludes $1,529 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 389.26% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -3.25% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $489,261 which includes $10,806 cash and excludes $6,369 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 114.19% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -1.71% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $214,186 which includes $35 cash and excludes $8,476 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 224.46% while the benchmark SPY gained 149.90% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -4.15% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $324,457 which includes $633 cash and excludes $3,385 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 26.55% while the benchmark SPY gained 29.73% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.20% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $126,546 which includes $2,837 cash and excludes $00 spent on fees and slippage. |

|

|

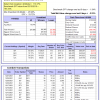

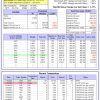

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 18.6%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.74% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $413,333 which includes $3,140 cash and excludes $7,395 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -7.7%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.38% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$20,863 which includes $77,619 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 10.0%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.86% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $285,862 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 22.9%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.91% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $818,229 which includes $13,437 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -4.4%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.71% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,276 which includes $6,604 cash and excludes $7,312 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 20.6%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of iM-Combo5 gained -2.23% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $213,525 which includes $2,597 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Since inception, on 7/1/2014, the model gained 203.59% while the benchmark SPY gained 168.26% and VDIGX gained 142.35% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.67% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $303,594 which includes $1,271 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.81% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $222,192 which includes $2,728 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 16.9%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Since inception, on 6/30/2014, the model gained 165.91% while the benchmark SPY gained 168.26% and the ETF USMV gained 138.56% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.65% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $265,910 which includes $1,765 cash and excludes $7,422 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 31.4%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Since inception, on 1/3/2013, the model gained 492.96% while the benchmark SPY gained 270.31% and the ETF USMV gained 270.31% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.17% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $592,964 which includes $223 cash and excludes $5,166 spent on fees and slippage. |

|

|

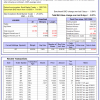

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.8%, and for the last 12 months is -0.5%. Over the same period the benchmark BND performance was -2.3% and -3.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.87% at a time when BND gained -0.84%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $147,600 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 10.0%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.86% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $285,862 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.54% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,571 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -3.0%, and for the last 12 months is 20.9%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.28% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $163,379 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 22.8%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.90% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $193,539 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was -3.9% and 23.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.71% at a time when SPY gained -1.94%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $174,204 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.