|

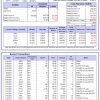

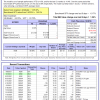

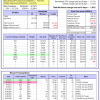

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 23.9%. Over the same period the benchmark E60B40 performance was 12.0% and 19.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.29% at a time when SPY gained -0.29%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $157,548 which includes $1,683 cash and excludes $1,784 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 27.0%. Over the same period the benchmark E60B40 performance was 12.0% and 19.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.26% at a time when SPY gained -0.29%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $162,315 which includes $1,166 cash and excludes $1,919 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 17.4%, and for the last 12 months is 30.0%. Over the same period the benchmark E60B40 performance was 12.0% and 19.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.22% at a time when SPY gained -0.29%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $166,972 which includes $1,052 cash and excludes $2,047 spent on fees and slippage. |

|

|

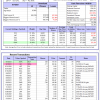

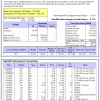

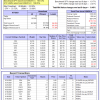

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 498.53% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.02% at a time when SPY gained -0.17%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $149,634 which includes $4,670 cash and excludes $1,499 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 431.70% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -1.07% at a time when SPY gained -0.17%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $132,926 which includes $356 cash and excludes $863 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 533.07% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.69% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $633,070 which includes -$855 cash and excludes $8,069 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 134.60% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.53% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $234,599 which includes $821 cash and excludes $6,509 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 271.40% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.97% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $371,398 which includes $1,328 cash and excludes $3,785 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 512.66% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.35% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $612,656 which includes $3,247 cash and excludes $1,607 spent on fees and slippage. |

|

|

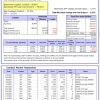

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 183.01% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.63% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $283,009 which includes $9 cash and excludes $1,393 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 398.72% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.43% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $498,719 which includes $915 cash and excludes $5,263 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 110.75% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.18% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $210,746 which includes $2,703 cash and excludes $7,691 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 227.86% while the benchmark SPY gained 145.50% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.48% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $327,858 which includes $1,062 cash and excludes $3,192 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 25.23% while the benchmark SPY gained 27.44% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.11% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $125,226 which includes $1,344 cash and excludes $00 spent on fees and slippage. |

|

|

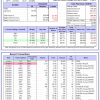

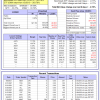

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 20.1%, and for the last 12 months is 38.1%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.47% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $406,583 which includes $621 cash and excludes $6,826 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.26% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $14,716 which includes $70,003 cash and excludes Gain to date spent on fees and slippage. |

|

|

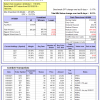

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 26.3%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.65% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $297,079 which includes $3,631 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 21.4%, and for the last 12 months is 33.3%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.17% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $803,958 which includes $8,034 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 27.2%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.23% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $196,665 which includes $3,592 cash and excludes $7,165 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 22.1%, and for the last 12 months is 37.9%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of iM-Combo5 gained 0.01% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $216,899 which includes $1,805 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Since inception, on 7/1/2014, the model gained 203.91% while the benchmark SPY gained 163.53% and VDIGX gained -100.00% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.95% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $303,906 which includes $931 cash and excludes $4,012 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 21.8%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.26% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $211,082 which includes $2,380 cash and excludes $1,888 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 21.7%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Since inception, on 6/30/2014, the model gained 158.19% while the benchmark SPY gained 163.53% and the ETF USMV gained 138.85% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.40% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $258,190 which includes $503 cash and excludes $7,357 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 24.4%, and for the last 12 months is 45.4%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Since inception, on 1/3/2013, the model gained 461.55% while the benchmark SPY gained 263.78% and the ETF USMV gained 263.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.75% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $562,037 which includes $2,172 cash and excludes $4,816 spent on fees and slippage. |

|

|

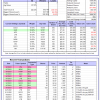

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 8.3%. Over the same period the benchmark BND performance was -1.2% and -0.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.66% at a time when BND gained -0.47%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $153,463 which includes $96 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 26.3%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.65% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $297,079 which includes $3,631 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.28% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,982 which includes $2,781 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 17.7%, and for the last 12 months is 28.0%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.21% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,202 which includes $4,061 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 21.3%, and for the last 12 months is 33.4%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.17% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $190,171 which includes $2,364 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 12.4%. Over the same period the benchmark SPY performance was 21.5% and 33.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.42% at a time when SPY gained -0.17%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,543 which includes -$1,665 cash and excludes $7,546 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.