|

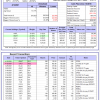

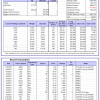

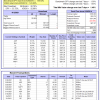

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 22.0%. Over the same period the benchmark E60B40 performance was 4.9% and 27.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.80% at a time when SPY gained 0.90%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,139 which includes $1,399 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 24.7%. Over the same period the benchmark E60B40 performance was 4.9% and 27.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.90% at a time when SPY gained 0.90%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,051 which includes $1,319 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 27.4%. Over the same period the benchmark E60B40 performance was 4.9% and 27.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.99% at a time when SPY gained 0.90%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $153,875 which includes $1,527 cash and excludes $2,045 spent on fees and slippage. |

|

|

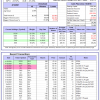

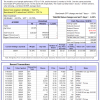

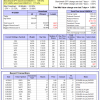

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 429.64% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.04% at a time when SPY gained 1.30%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $132,440 which includes -$4,773 cash and excludes $1,331 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 395.97% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.27% at a time when SPY gained 1.30%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $123,992 which includes $158 cash and excludes $750 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 499.89% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $599,893 which includes $12 cash and excludes $6,995 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 111.12% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $211,122 which includes $4,346 cash and excludes $5,888 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 267.66% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $367,661 which includes $2,101 cash and excludes $3,273 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 455.49% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $555,490 which includes $4,109 cash and excludes $1,573 spent on fees and slippage. |

|

|

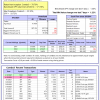

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 181.85% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.94% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,849 which includes $501 cash and excludes $1,257 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 295.38% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $395,380 which includes $134 cash and excludes $5,075 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 96.99% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $196,991 which includes $4,061 cash and excludes $7,036 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 214.34% while the benchmark SPY gained 123.11% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.31% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $314,338 which includes $2,079 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 17.83% while the benchmark SPY gained 15.82% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.04% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $117,830 which includes $348 cash and excludes $00 spent on fees and slippage. |

|

|

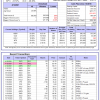

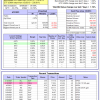

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.5%, and for the last 12 months is 81.5%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.36% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $397,724 which includes $3,657 cash and excludes $6,553 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 17.6%, and for the last 12 months is 54.0%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.32% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $74,829 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

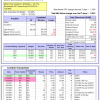

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 44.5%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.28% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $285,512 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 32.5%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.29% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $731,330 which includes $5,608 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 29.6%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.22% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $179,983 which includes $533 cash and excludes $6,912 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 53.3%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of iM-Combo5 gained 1.68% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $194,550 which includes $1,174 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 8.5%, and for the last 12 months is 29.4%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Since inception, on 7/1/2014, the model gained 193.55% while the benchmark SPY gained 139.50% and VDIGX gained 124.82% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.49% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $293,552 which includes $838 cash and excludes $3,880 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 55.1%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.51% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $211,262 which includes $1,792 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Since inception, on 6/30/2014, the model gained 156.33% while the benchmark SPY gained 139.50% and the ETF USMV gained 117.94% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.55% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $256,332 which includes $1,657 cash and excludes $7,285 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 20.2%, and for the last 12 months is 61.1%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Since inception, on 1/3/2013, the model gained 442.38% while the benchmark SPY gained 230.61% and the ETF USMV gained 230.61% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.19% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $542,378 which includes $117 cash and excludes $4,689 spent on fees and slippage. |

|

|

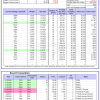

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 16.5%. Over the same period the benchmark BND performance was -3.2% and -0.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.00% at a time when BND gained 0.31%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $149,924 which includes $5,582 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 44.5%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.28% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $285,512 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.53% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $136,473 which includes $2,151 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 32.4%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.34% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,612 which includes $3,152 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 24.2%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.29% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $173,034 which includes $1,792 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.3%, and for the last 12 months is 17.0%. Over the same period the benchmark SPY performance was 10.5% and 50.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.26% at a time when SPY gained 1.30%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $164,148 which includes $734 cash and excludes $6,875 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.