|

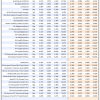

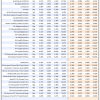

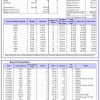

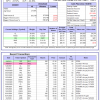

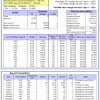

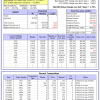

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

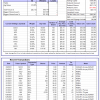

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 7.7%. Over the same period the benchmark E60B40 performance was 2.2% and 15.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 2.77% at a time when SPY gained 2.14%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,062 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 7.2%. Over the same period the benchmark E60B40 performance was 2.2% and 15.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 3.18% at a time when SPY gained 2.14%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $146,084 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 6.7%. Over the same period the benchmark E60B40 performance was 2.2% and 15.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.58% at a time when SPY gained 2.14%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $149,012 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

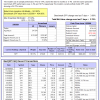

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 444.43% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 6.86% at a time when SPY gained 3.80%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $136,108 which includes $4,950 cash and excludes $1,219 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 406.00% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 5.50% at a time when SPY gained 3.80%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $126,500 which includes $112 cash and excludes $718 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 426.71% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $526,712 which includes $1,748 cash and excludes $6,231 spent on fees and slippage. |

|

|

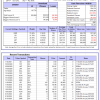

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 91.80% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $191,799 which includes -$893 cash and excludes $5,400 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 219.12% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $319,125 which includes $997 cash and excludes $3,244 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 404.00% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $504,003 which includes $1,611 cash and excludes $1,573 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 162.66% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.48% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,664 which includes $314 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 297.65% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $397,647 which includes $2,311 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 91.00% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $191,004 which includes $2,358 cash and excludes $6,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 189.78% while the benchmark SPY gained 110.97% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $289,781 which includes $924 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 8.74% while the benchmark SPY gained 9.52% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 5.26% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $108,737 which includes $943 cash and excludes $00 spent on fees and slippage. |

|

|

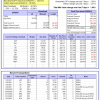

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 8.0%, and for the last 12 months is 45.7%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 5.33% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $365,863 which includes $279 cash and excludes $6,198 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 89.1%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 9.37% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 3.78% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $691,825 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.09% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $176,753 which includes $6,355 cash and excludes $6,793 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of iM-Combo5 gained 2.56% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $185,438 which includes $1,640 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 7.9%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Since inception, on 7/1/2014, the model gained 169.43% while the benchmark SPY gained 126.47% and VDIGX gained 68.95% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.96% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $269,432 which includes $150 cash and excludes $3,812 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.85% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $193,176 which includes $133 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is -3.5%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Since inception, on 6/30/2014, the model gained 130.43% while the benchmark SPY gained 126.47% and the ETF USMV gained 108.46% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.62% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $230,429 which includes $201 cash and excludes $7,197 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 19.8%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Since inception, on 1/3/2013, the model gained 358.16% while the benchmark SPY gained 212.62% and the ETF USMV gained 170.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.70% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $458,157 which includes $491 cash and excludes $3,625 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -1.2%. Over the same period the benchmark BND performance was -1.1% and 4.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.95% at a time when BND gained -0.30%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,039 which includes $4,587 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -5.1%, and for the last 12 months is -22.6%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of iM-Best(Short) gained -2.95% at a time when SPY gained 3.80%. Over the period 1/2/2009 to 2/8/2021 the starting capital of $100,000 would have grown to $62,338 which includes $74,860 cash and excludes $30,227 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 0.3%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.43% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,021 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.82% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,970 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 3.77% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $163,712 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 20.5%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.38% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,475 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is -3.2%. Over the same period the benchmark SPY performance was 4.4% and 19.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.09% at a time when SPY gained 3.80%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $111,447 which includes $2,594 cash and excludes $2,292 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.