|

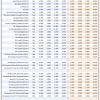

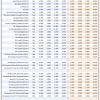

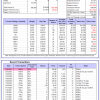

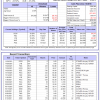

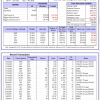

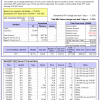

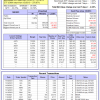

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

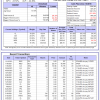

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 17.1%. Over the same period the benchmark E60B40 performance was 13.3% and 14.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.17% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $158,911 which includes $637 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 16.7%, and for the last 12 months is 18.8%. Over the same period the benchmark E60B40 performance was 13.3% and 14.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.31% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $163,660 which includes $116 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 18.3%, and for the last 12 months is 20.5%. Over the same period the benchmark E60B40 performance was 13.3% and 14.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.44% at a time when SPY gained -0.59%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $168,260 which includes $1,640 cash and excludes $2,047 spent on fees and slippage. |

|

|

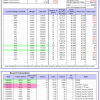

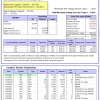

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 436.64% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -6.34% at a time when SPY gained -1.25%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $134,160 which includes $2,073 cash and excludes $1,563 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 362.95% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -9.33% at a time when SPY gained -1.25%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $115,738 which includes $3,263 cash and excludes $981 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 579.89% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.86% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $679,887 which includes $505 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 130.29% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.66% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $230,290 which includes $1,189 cash and excludes $7,048 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 280.30% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.10% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $380,299 which includes $2,183 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 502.03% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.74% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $602,025 which includes $1,304 cash and excludes $1,675 spent on fees and slippage. |

|

|

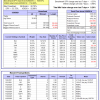

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 187.07% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.17% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,067 which includes $991 cash and excludes $1,512 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 377.26% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.67% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $477,262 which includes -$3,260 cash and excludes $6,129 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 111.85% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.79% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $211,853 which includes -$982 cash and excludes $8,159 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 249.95% while the benchmark SPY gained 150.28% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.42% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $349,952 which includes $5,538 cash and excludes $3,379 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.72% while the benchmark SPY gained 29.92% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.54% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $124,722 which includes $2,640 cash and excludes $00 spent on fees and slippage. |

|

|

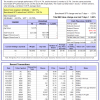

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 15.0%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.23% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $389,229 which includes $1,081 cash and excludes $7,202 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 25.7%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 3.82% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.65% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,793 which includes $4,259 cash and excludes $862 spent on fees and slippage. |

|

|

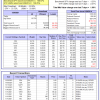

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 23.7%, and for the last 12 months is 25.6%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.23% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $819,398 which includes $10,552 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 19.6%, and for the last 12 months is 22.6%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.84% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $205,353 which includes $3,759 cash and excludes $7,309 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 25.6%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of iM-Combo5 gained -1.90% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $222,986 which includes $48,279 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 16.5%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Since inception, on 7/1/2014, the model gained 211.56% while the benchmark SPY gained 168.67% and VDIGX gained 150.80% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.26% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $311,558 which includes $1,158 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.48% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $206,696 which includes $1,841 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Since inception, on 6/30/2014, the model gained 153.54% while the benchmark SPY gained 168.67% and the ETF USMV gained 139.25% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.96% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $253,539 which includes $419 cash and excludes $7,381 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 21.2%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Since inception, on 1/3/2013, the model gained 446.87% while the benchmark SPY gained 270.87% and the ETF USMV gained 270.87% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.35% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $546,871 which includes $3,060 cash and excludes $5,028 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 3.7%. Over the same period the benchmark BND performance was -1.4% and -0.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.66% at a time when BND gained 0.38%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $152,791 which includes $424 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.65% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,793 which includes $4,259 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.22% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,324 which includes $3,479 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 19.1%, and for the last 12 months is 19.8%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.50% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,110 which includes $4,954 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 23.6%, and for the last 12 months is 25.5%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.23% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $193,815 which includes $2,958 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was 23.9% and 25.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.28% at a time when SPY gained -1.25%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,000 which includes $475 cash and excludes $7,877 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.