|

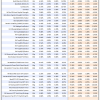

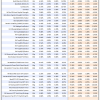

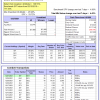

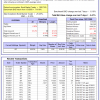

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

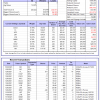

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 18.3%, and for the last 12 months is 19.2%. Over the same period the benchmark E60B40 performance was 16.2% and 17.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.49% at a time when SPY gained 2.88%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $163,306 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 20.4%, and for the last 12 months is 21.3%. Over the same period the benchmark E60B40 performance was 16.2% and 17.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 3.89% at a time when SPY gained 2.88%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $168,758 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 22.3%, and for the last 12 months is 23.3%. Over the same period the benchmark E60B40 performance was 16.2% and 17.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 4.26% at a time when SPY gained 2.88%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $174,056 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

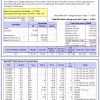

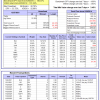

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 456.38% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.59% at a time when SPY gained 4.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $139,095 which includes $3,562 cash and excludes $1,565 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 375.98% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 4.05% at a time when SPY gained 4.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $118,994 which includes -$2 cash and excludes $985 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 629.43% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 9.08% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $729,427 which includes $796 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 137.61% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 5.30% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $237,610 which includes $2,984 cash and excludes $7,161 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 286.38% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 3.64% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $386,382 which includes $2,183 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 551.01% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 5.41% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $651,008 which includes $1,593 cash and excludes $1,675 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 196.69% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.54% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $296,687 which includes $1,342 cash and excludes $1,529 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 407.96% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.70% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $507,959 which includes -$2,314 cash and excludes $6,129 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 115.20% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.44% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $215,197 which includes $351 cash and excludes $8,367 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 247.81% while the benchmark SPY gained 161.27% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.96% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $347,813 which includes $633 cash and excludes $3,385 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.86% while the benchmark SPY gained 35.63% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.73% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,860 which includes $2,314 cash and excludes $00 spent on fees and slippage. |

|

|

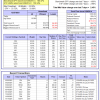

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 19.5%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 4.29% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $401,188 which includes $1,867 cash and excludes $7,202 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.10% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.47% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,002 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 29.0%, and for the last 12 months is 30.7%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of Best(SPY-SH) gained 4.82% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $854,846 which includes $13,437 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 23.5%, and for the last 12 months is 25.5%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.51% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $212,143 which includes $6,604 cash and excludes $7,312 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 29.3%, and for the last 12 months is 31.6%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of iM-Combo5 gained 4.42% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $229,709 which includes $2,597 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 18.1%, and for the last 12 months is 19.0%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Since inception, on 7/1/2014, the model gained 219.62% while the benchmark SPY gained 180.47% and VDIGX gained 161.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.45% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $319,621 which includes $1,158 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.87% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $215,170 which includes $2,496 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 17.0%, and for the last 12 months is 18.4%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Since inception, on 6/30/2014, the model gained 162.52% while the benchmark SPY gained 180.47% and the ETF USMV gained 150.34% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.45% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $262,525 which includes $1,554 cash and excludes $7,422 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 26.5%, and for the last 12 months is 27.8%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Since inception, on 1/3/2013, the model gained 470.90% while the benchmark SPY gained 287.16% and the ETF USMV gained 287.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.70% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $570,897 which includes $4,031 cash and excludes $5,028 spent on fees and slippage. |

|

|

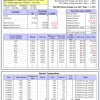

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 2.7%. Over the same period the benchmark BND performance was -1.7% and -1.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.47% at a time when BND gained -0.10%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $152,378 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.47% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,002 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 17.6%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.33% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,323 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 23.5%, and for the last 12 months is 25.2%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.64% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,962 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 28.9%, and for the last 12 months is 30.6%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 4.80% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $202,179 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 7.9%, and for the last 12 months is 9.0%. Over the same period the benchmark SPY performance was 29.4% and 31.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 7.22% at a time when SPY gained 4.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,305 which includes $3,185 cash and excludes $8,212 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.