|

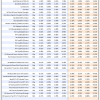

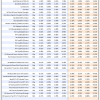

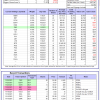

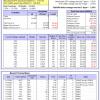

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

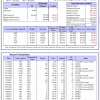

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 22.6%. Over the same period the benchmark E60B40 performance was 14.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.69% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $161,621 which includes $558 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 19.0%, and for the last 12 months is 25.2%. Over the same period the benchmark E60B40 performance was 14.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.66% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $166,840 which includes $55 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 20.8%, and for the last 12 months is 27.7%. Over the same period the benchmark E60B40 performance was 14.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.63% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $171,910 which includes $1,601 cash and excludes $2,047 spent on fees and slippage. |

|

|

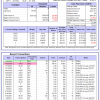

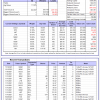

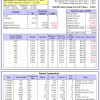

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 476.99% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -2.62% at a time when SPY gained 0.03%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $144,247 which includes $2,060 cash and excludes $1,563 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 407.34% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.56% at a time when SPY gained 0.03%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $126,836 which includes $1,384 cash and excludes $979 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 573.19% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.84% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $673,194 which includes $295 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 137.64% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.26% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $237,639 which includes $42 cash and excludes $7,048 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 287.76% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.83% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $387,762 which includes $1,227 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 487.54% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.63% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $587,539 which includes $1,304 cash and excludes $1,675 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 187.61% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -2.13% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,610 which includes $991 cash and excludes $1,512 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 372.95% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.62% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $472,953 which includes $1,857 cash and excludes $5,880 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 109.21% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.05% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $209,214 which includes -$982 cash and excludes $8,159 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 270.00% while the benchmark SPY gained 155.07% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.58% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $370,002 which includes $750 cash and excludes $3,231 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.95% while the benchmark SPY gained 32.41% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.93% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,947 which includes $1,952 cash and excludes $00 spent on fees and slippage. |

|

|

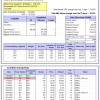

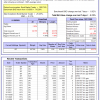

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 22.7%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.86% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $387,587 which includes $2,344 cash and excludes $7,106 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 28.9%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.85% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.13% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $291,141 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 26.0%, and for the last 12 months is 33.2%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.03% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $834,878 which includes $10,552 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 21.3%, and for the last 12 months is 30.8%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.45% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $208,338 which includes $3,258 cash and excludes $7,171 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 28.6%, and for the last 12 months is 40.5%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of iM-Combo5 gained 0.63% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $228,467 which includes $380 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Since inception, on 7/1/2014, the model gained 210.23% while the benchmark SPY gained 173.81% and VDIGX gained 151.63% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.31% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $310,230 which includes $890 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 9.7%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.85% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $206,325 which includes $1,310 cash and excludes $1,899 spent on fees and slippage. |

|

|

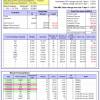

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Since inception, on 6/30/2014, the model gained 149.81% while the benchmark SPY gained 173.81% and the ETF USMV gained 140.40% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.39% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $249,809 which includes $219 cash and excludes $7,381 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 23.0%, and for the last 12 months is 29.1%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Since inception, on 1/3/2013, the model gained 455.06% while the benchmark SPY gained 277.96% and the ETF USMV gained 277.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.36% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $555,057 which includes $1,958 cash and excludes $5,028 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 3.5%. Over the same period the benchmark BND performance was -2.3% and -2.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.13% at a time when BND gained -0.02%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,359 which includes $309 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.13% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $291,141 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.75% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,476 which includes $3,479 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 19.4%, and for the last 12 months is 22.2%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.71% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,456 which includes $4,954 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 25.9%, and for the last 12 months is 33.0%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.03% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $197,467 which includes $2,958 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 2.7%. Over the same period the benchmark SPY performance was 26.3% and 33.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -3.12% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $168,503 which includes $475 cash and excludes $7,877 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.