|

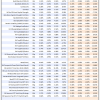

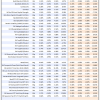

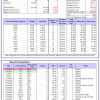

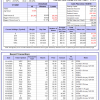

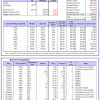

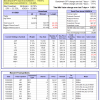

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 6.4%. Over the same period the benchmark E60B40 performance was 0.3% and 14.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.62% at a time when SPY gained 1.20%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $139,062 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 5.8%. Over the same period the benchmark E60B40 performance was 0.3% and 14.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 2.03% at a time when SPY gained 1.20%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $141,613 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 5.0%. Over the same period the benchmark E60B40 performance was 0.3% and 14.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 2.43% at a time when SPY gained 1.20%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $144,075 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

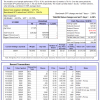

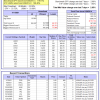

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 408.53% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.45% at a time when SPY gained 2.68%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $127,163 which includes $7,998 cash and excludes $1,216 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 373.98% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 1.30% at a time when SPY gained 2.68%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $118,495 which includes $112 cash and excludes $718 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 403.83% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $503,828 which includes $1,099 cash and excludes $6,189 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 90.54% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $190,541 which includes $1,152 cash and excludes $5,227 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 208.07% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $308,066 which includes $518 cash and excludes $3,244 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 391.52% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $491,519 which includes $1,611 cash and excludes $1,573 spent on fees and slippage. |

|

|

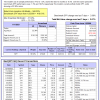

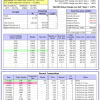

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 157.34% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.93% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $257,336 which includes $1,300 cash and excludes $1,132 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 285.27% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $385,274 which includes $1,448 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 88.14% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $188,139 which includes $2,358 cash and excludes $6,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 161.22% while the benchmark SPY gained 104.58% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 2.19% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $261,223 which includes $924 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 4.14% while the benchmark SPY gained 6.20% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 4.54% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $104,137 which includes $1,244 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 36.4%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.25% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $344,902 which includes $1,646 cash and excludes $6,000 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 70.1%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -6.38% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

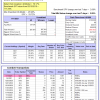

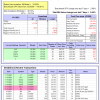

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -6.5%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.67% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $670,986 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is -2.4%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.14% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $173,756 which includes $5,665 cash and excludes $6,682 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of iM-Combo5 gained 3.09% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $179,453 which includes $1,278 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Since inception, on 7/1/2014, the model gained 168.21% while the benchmark SPY gained 119.61% and VDIGX gained 106.88% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.92% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $268,206 which includes $477 cash and excludes $3,805 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 5.8%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.69% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $189,128 which includes $32,547 cash and excludes $1,592 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Since inception, on 6/30/2014, the model gained 128.61% while the benchmark SPY gained 119.61% and the ETF USMV gained 108.46% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.85% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $228,606 which includes $2,883 cash and excludes $7,158 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Since inception, on 1/3/2013, the model gained 356.95% while the benchmark SPY gained 203.15% and the ETF USMV gained 170.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.97% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $456,949 which includes $215 cash and excludes $3,625 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.25% at a time when BND gained -1.01%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $148,053 which includes $4,060 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -16.7%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of iM-Best(Short) gained 0.65% at a time when SPY gained 2.68%. Over the period 1/2/2009 to 1/11/2021 the starting capital of $100,000 would have grown to $66,299 which includes $130,983 cash and excludes $29,900 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.52% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,328 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.41% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,459 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.66% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,795 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.75% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $161,653 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is -1.9%. Over the same period the benchmark SPY performance was 1.3% and 18.4% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.51% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $110,206 which includes $2,594 cash and excludes $2,292 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.