- For what is considered to be a lagging indicator of the economy, the unemployment rate provides surprisingly good signals for the beginning and end of recessions.

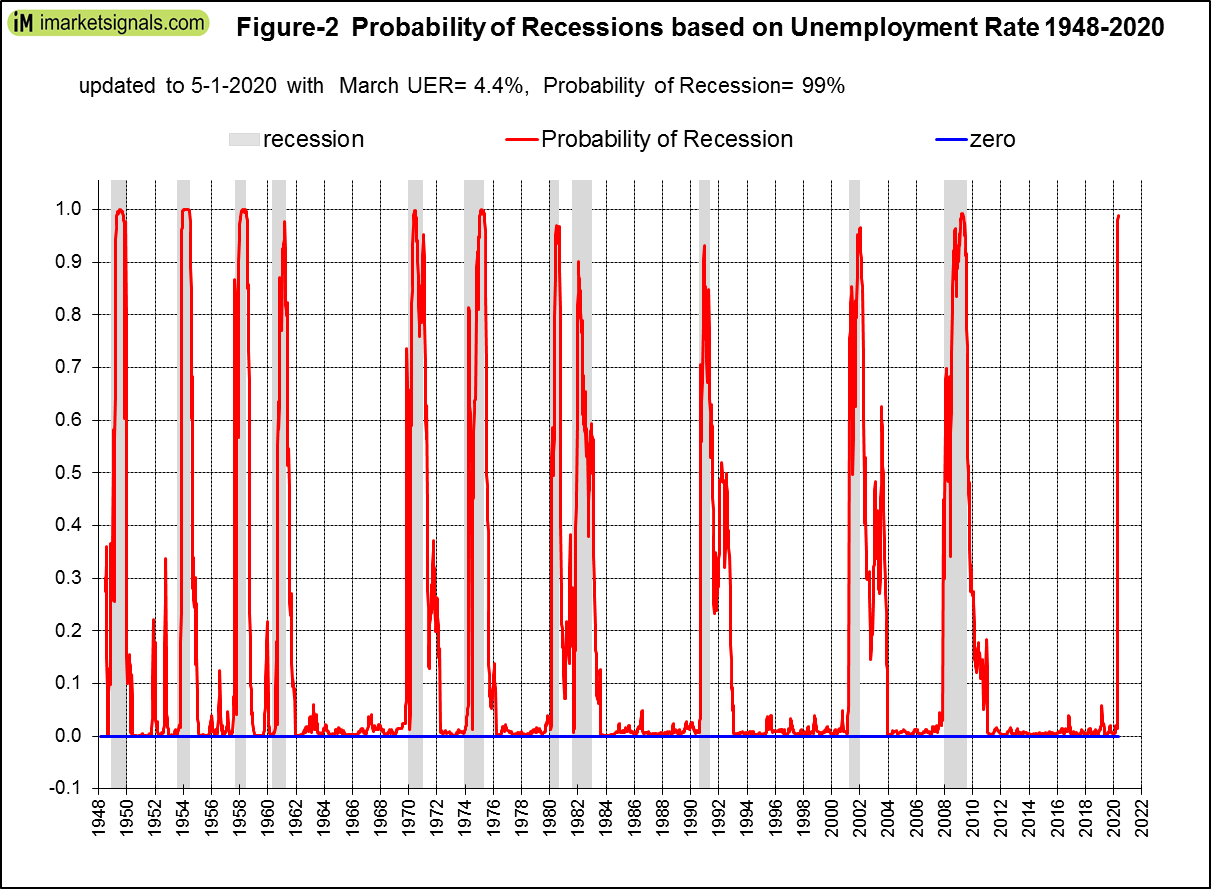

- This model, backtested to 1948, reliably provided recession signals.

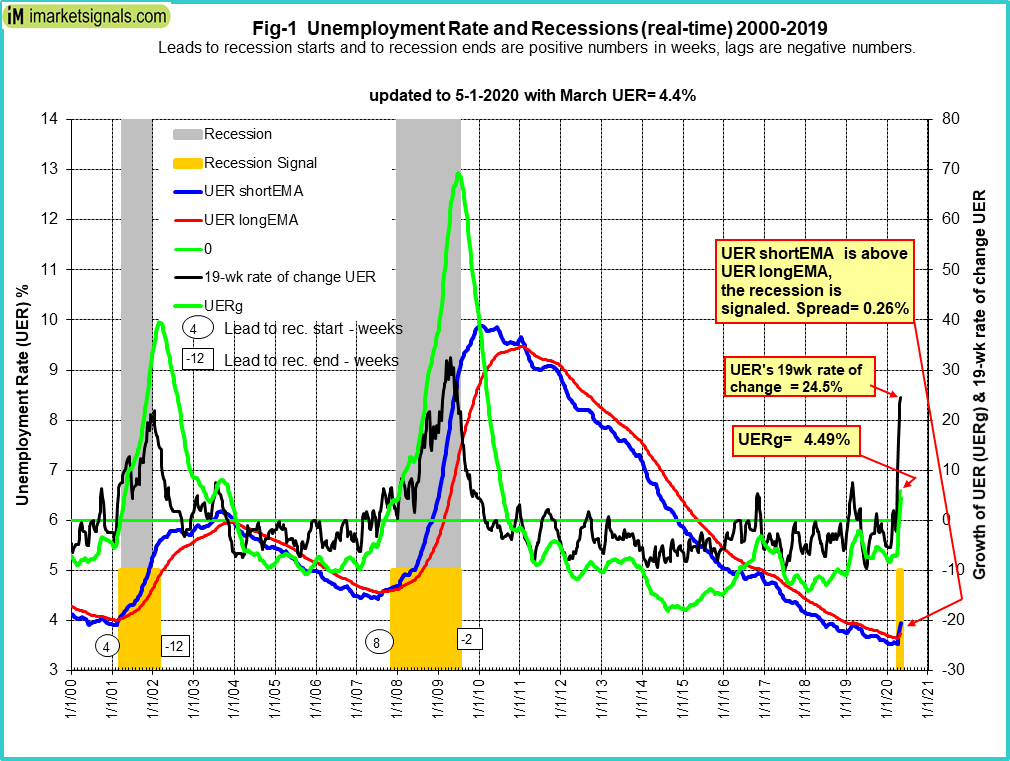

- The model, updated with the March 2020 rate of 4.4%, does now signal a recession.

A reliable source for recession forecasting is the unemployment rate, which can provide signals for the beginning and end of recessions (Appendix B charts the UER recession indicator for the period 1948 to 2015).

As anticipated (article link), the unemployment rate model (article link) updated with the March 2020 rate of 4.4% does now signal a recession.

The model relies on four indicators to signal recessions:

- The short 12-period and a long 60-period exponential moving average (EMA) of the unemployment rate (UER).

- The eight-month smoothed annualized growth rate of the UER (UERg).

- The 19-week rate of change of the UER.

The criteria for the model to signal the start of recessions are given in the original article and repeated in the Appendix.

Referring to the chart below and looking at the end portion of it, one can see that all three of the conditions for the start of a recession have been met.

- The UER at 4.4% is up from last month. The short EMA is above its long EMA, the blue and red graphs, respectively, and the spread, now at plus 0.26%, last month’s minus 0.11%.

- UERg rose from minus 7.01% to plus 4.49%, far above zero – the green graph.

- Also, the 19-week rate of change of the UER increased to plus 24.5%, also far above the 8% critical level – the black graph.

Based on the historic patterns of the unemployment rate indicators prior to recessions, one can reasonably conclude that the U.S. economy has enetered a recession.

Recession Probability

The probability of an imminent recession is 99%, as shown in the Figure below. The probability plot spans the period 1948 to 2020, encompassing eleven recessions.

Leads to recession starts

Leads to recession start from the UER model for the last eleven recessions:

- Maximum lead time = 21 weeks (out of seven early signals)

- Minimum lead time = -14 weeks (out of four late signals)

- Average lead time = 2 weeks

Appendix

The model signals the start of a recession when any one of the following three conditions occurs:

- The short exponential moving average (EMA) of the unemployment rate (UER) rises and crosses the long EMA to the upside, and the difference between the two EMAs is at least 0.07.

- The unemployment rate growth rate (UERg) rises above zero, while the long EMA of the unemployment rate has a positive slope, and the difference between the long EMA at that time and the long EMA 10 weeks before is greater than 0.025.

- The 19-week rate of change of the UER is greater than 8.0%, while simultaneously the long EMA of the UER has a positive slope and the difference between the long EMA at the time and the long EMA 10 weeks earlier is greater than 0.015.

Leave a Reply

You must be logged in to post a comment.