|

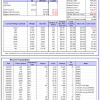

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

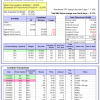

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -2.4%, and for the last 12 months is 3.7%. Over the same period the benchmark E60B40 performance was 7.9% and 13.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.13% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $126,424 which includes -$17 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 2.5%. Over the same period the benchmark E60B40 performance was 7.9% and 13.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.32% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $126,963 which includes -$142 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 1.3%. Over the same period the benchmark E60B40 performance was 7.9% and 13.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.51% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $127,416 which includes $25 cash and excludes $2,045 spent on fees and slippage. |

|

|

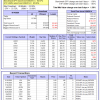

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 327.19% while the benchmark SPY gained 81.35% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.50% at a time when SPY gained 1.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,797 which includes $7,455 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 304.14% while the benchmark SPY gained 81.35% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.14% at a time when SPY gained 1.58%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $101,035 which includes $490 cash and excludes $667 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.6%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.79% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $296,229 which includes $595 cash and excludes $5,490 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 50.3%, and for the last 12 months is 138.0%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.91% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $244 which includes $59,265 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -16.0%, and for the last 12 months is -9.3%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.65% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $595,532 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.7%, and for the last 12 months is -10.3%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.20% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $154,623 which includes $1,526 cash and excludes $6,568 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of iM-Combo5 gained 2.31% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $154,862 which includes $680 cash and excludes $0 spent on fees and slippage. |

|

|

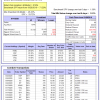

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Since inception, on 7/1/2014, the model gained 155.33% while the benchmark SPY gained 94.67% and VDIGX gained 91.61% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.73% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $255,335 which includes $913 cash and excludes $3,635 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.80% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $174,357 which includes $1,905 cash and excludes $1,396 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is 0.8%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Since inception, on 6/30/2014, the model gained 111.63% while the benchmark SPY gained 94.67% and the ETF USMV gained 95.80% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.39% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $211,811 which includes $1,691 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.1%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Since inception, on 1/3/2013, the model gained 286.27% while the benchmark SPY gained 168.72% and the ETF USMV gained 154.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.17% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $386,273 which includes $4,327 cash and excludes $3,495 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -34.0%, and for the last 12 months is -29.0%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.40% at a time when BND gained 0.05%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $141,497 which includes $1,712 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.8%, and for the last 12 months is -10.6%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of iM-Best(Short) gained -0.18% at a time when SPY gained 1.58%. Over the period 1/2/2009 to 9/14/2020 the starting capital of $100,000 would have grown to $74,143 which includes $89,100 cash and excludes $28,524 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.2%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.62% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,244 which includes $56 cash and excludes $1,385 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.7%, and for the last 12 months is -1.5%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.48% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,578 which includes $644 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -17.3%, and for the last 12 months is -12.2%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.79% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $126,812 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.8%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.58% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,845 which includes $46 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.57% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,050 which includes -$1,009 cash and excludes $5,636 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is -5.1%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.48% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $101,670 which includes -$433 cash and excludes $2,017 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -34.0%, and for the last 12 months is -29.0%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.41% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $103,887 which includes -$305 cash and excludes $4,498 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -20.1%, and for the last 12 months is -14.1%. Over the same period the benchmark SPY performance was 6.2% and 14.7% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.91% at a time when SPY gained 1.58%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $108,587 which includes -$570 cash and excludes $4,241 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.