|

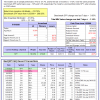

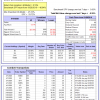

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 0.9%. Over the same period the benchmark E60B40 performance was -1.9% and 8.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.53% at a time when SPY gained 0.77%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $120,479 which includes -$3,464 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -8.7%, and for the last 12 months is -0.6%. Over the same period the benchmark E60B40 performance was -1.9% and 8.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.54% at a time when SPY gained 0.77%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $121,028 which includes -$4,316 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.5%, and for the last 12 months is -2.1%. Over the same period the benchmark E60B40 performance was -1.9% and 8.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.54% at a time when SPY gained 0.77%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $121,505 which includes -$5,123 cash and excludes $1,786 spent on fees and slippage. |

|

|

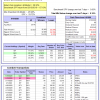

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -27.7%, and for the last 12 months is -17.2%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.14% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $512,783 which includes -$31,787 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -23.8%, and for the last 12 months is -15.3%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.04% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $134,847 which includes $2,800 cash and excludes $6,084 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -16.7%, and for the last 12 months is -5.7%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of iM-Combo5 gained 0.15% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $128,321 which includes $2,259 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 10.8%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Since inception, on 7/1/2014, the model gained 129.66% while the benchmark SPY gained 68.93% and VDIGX gained 67.08% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.49% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $229,661 which includes $360 cash and excludes $3,319 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -25.0%, and for the last 12 months is -18.8%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.81% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $133,193 which includes $2,618 cash and excludes $1,245 spent on fees and slippage. |

|

|

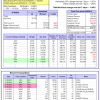

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -17.5%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Since inception, on 6/30/2014, the model gained 93.68% while the benchmark SPY gained 68.93% and the ETF USMV gained 80.52% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.42% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $193,679 which includes -$290 cash and excludes $6,953 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -9.4%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Since inception, on 1/3/2013, the model gained 229.96% while the benchmark SPY gained 133.19% and the ETF USMV gained 134.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.16% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $329,959 which includes -$497 cash and excludes $3,481 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -33.1%, and for the last 12 months is -28.7%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.90% at a time when BND gained 0.59%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $132,209 which includes -$517 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -3.4%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 0.85%. Over the period 1/2/2009 to 5/18/2020 the starting capital of $100,000 would have grown to $77,754 which includes $77,754 cash and excludes $27,631 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.87% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,602 which includes $174 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -14.6%, and for the last 12 months is -6.2%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.92% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,853 which includes $1,198 cash and excludes $00 spent on fees and slippage. |

|

|

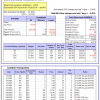

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -28.2%, and for the last 12 months is -19.9%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.39% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,181 which includes $3,151 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -14.4%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.01% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $139,835 which includes -$12,029 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -35.2%, and for the last 12 months is -39.4%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.01% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,503 which includes $5,242 cash and excludes $8,803 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 6.1%, and for the last 12 months is 12.4%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.72% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,155 which includes $7,876 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.45% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $99,061 which includes $24,029 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -33.1%, and for the last 12 months is -28.7%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.48% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $105,258 which includes $7,824 cash and excludes $3,972 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -20.3%, and for the last 12 months is -13.2%. Over the same period the benchmark SPY performance was -7.8% and 5.3% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.25% at a time when SPY gained 0.85%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $108,192 which includes $9,171 cash and excludes $3,652 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.