|

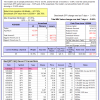

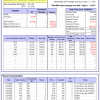

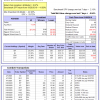

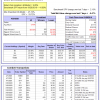

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

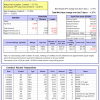

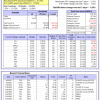

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -7.8%, and for the last 12 months is -0.9%. Over the same period the benchmark E60B40 performance was -4.7% and 4.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.05% at a time when SPY gained 1.42%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $119,423 which includes -$3,563 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -2.7%. Over the same period the benchmark E60B40 performance was -4.7% and 4.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.05% at a time when SPY gained 1.42%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $119,959 which includes -$4,416 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -11.3%, and for the last 12 months is -4.4%. Over the same period the benchmark E60B40 performance was -4.7% and 4.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.05% at a time when SPY gained 1.42%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $120,426 which includes -$5,224 cash and excludes $1,786 spent on fees and slippage. |

|

|

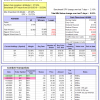

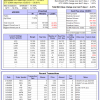

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -23.6%, and for the last 12 months is -13.9%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.85% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $541,181 which includes $1,215 cash and excludes $24,132 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -22.5%, and for the last 12 months is -14.5%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.27% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $137,148 which includes $4,752 cash and excludes $5,994 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -17.2%, and for the last 12 months is -7.9%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of iM-Combo5 gained 0.53% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $127,594 which includes -$1,307 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is 11.7%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Since inception, on 7/1/2014, the model gained 128.42% while the benchmark SPY gained 61.25% and VDIGX gained 64.29% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.55% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $228,423 which includes $915 cash and excludes $3,019 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -28.2%, and for the last 12 months is -24.8%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.63% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $127,515 which includes $2,534 cash and excludes $1,124 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -14.2%, and for the last 12 months is -1.6%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Since inception, on 6/30/2014, the model gained 101.44% while the benchmark SPY gained 61.25% and the ETF USMV gained 77.68% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.26% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $201,437 which includes $771 cash and excludes $6,718 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -10.5%, and for the last 12 months is -5.8%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Since inception, on 1/3/2013, the model gained 225.81% while the benchmark SPY gained 122.59% and the ETF USMV gained 130.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.41% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $325,815 which includes $2,233 cash and excludes $3,449 spent on fees and slippage. |

|

|

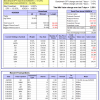

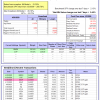

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -31.3%, and for the last 12 months is -29.9%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.14% at a time when BND gained 0.26%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $129,822 which includes -$793 cash and excludes $2,034 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of iM-Best(Short) gained 0.45% at a time when SPY gained 2.15%. Over the period 1/2/2009 to 4/20/2020 the starting capital of $100,000 would have grown to $84,697 which includes $119,033 cash and excludes $27,450 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -11.1%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.20% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,764 which includes -$1,964 cash and excludes $1,010 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -17.5%, and for the last 12 months is -9.4%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.74% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,040 which includes $1,057 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -31.9%, and for the last 12 months is -25.8%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -3.12% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,421 which includes $3,151 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.8%, and for the last 12 months is -8.5%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.23% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,765 which includes -$12,189 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -34.8%, and for the last 12 months is -41.9%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.09% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,209 which includes $5,120 cash and excludes $8,803 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.32% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $136,373 which includes $7,648 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -12.3%, and for the last 12 months is -6.0%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.35% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $98,775 which includes $23,883 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -31.3%, and for the last 12 months is -29.9%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.84% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $108,066 which includes $7,753 cash and excludes $3,972 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -19.5%, and for the last 12 months is -13.5%. Over the same period the benchmark SPY performance was -12.0% and -0.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.47% at a time when SPY gained 2.15%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $109,280 which includes $9,082 cash and excludes $3,652 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.