|

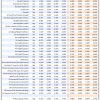

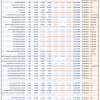

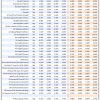

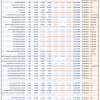

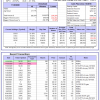

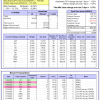

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

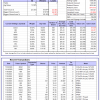

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 5.1%. Over the same period the benchmark E60B40 performance was 12.9% and 14.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.87% at a time when SPY gained 0.86%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $133,604 which includes $575 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 4.1%. Over the same period the benchmark E60B40 performance was 12.9% and 14.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.92% at a time when SPY gained 0.86%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $135,259 which includes $429 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 3.1%. Over the same period the benchmark E60B40 performance was 12.9% and 14.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.97% at a time when SPY gained 0.86%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $136,823 which includes $573 cash and excludes $2,045 spent on fees and slippage. |

|

|

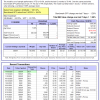

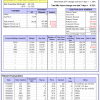

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 379.20% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.52% at a time when SPY gained 1.29%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $119,800 which includes $12,749 cash and excludes $1,202 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 354.94% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 5.23% at a time when SPY gained 1.29%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $113,735 which includes $103 cash and excludes $707 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 364.58% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $464,579 which includes -$16 cash and excludes $5,984 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 76.85% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $176,999 which includes $327 cash and excludes $5,061 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 208.27% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $308,269 which includes $1,930 cash and excludes $3,242 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 337.86% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $437,860 which includes $654 cash and excludes $1,539 spent on fees and slippage. |

|

|

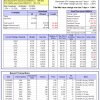

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 156.36% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.61% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $256,364 which includes $866 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 253.42% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $353,422 which includes $706 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 97.19% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $197,186 which includes $1,138 cash and excludes $6,444 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 158.84% while the benchmark SPY gained 94.77% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.93% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $258,839 which includes $233 cash and excludes $2,742 spent on fees and slippage. |

|

|

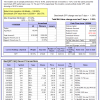

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 29.3%, and for the last 12 months is 32.9%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.39% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $325,720 which includes $4,156 cash and excludes $5,720 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 43.0%, and for the last 12 months is 78.4%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.98% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

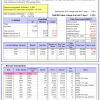

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is -7.2%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.29% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $638,882 which includes $570 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -8.0%, and for the last 12 months is -6.5%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.15% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $162,854 which includes $3,099 cash and excludes $6,679 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of iM-Combo5 gained 2.81% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $167,512 which includes $1,132 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Since inception, on 7/1/2014, the model gained 165.39% while the benchmark SPY gained 109.08% and VDIGX gained 101.85% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.73% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $265,392 which includes $840 cash and excludes $3,800 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.8%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.35% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $182,673 which includes $31,382 cash and excludes $1,592 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -9.3%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Since inception, on 6/30/2014, the model gained 113.16% while the benchmark SPY gained 109.08% and the ETF USMV gained 103.31% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.64% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $213,160 which includes $610 cash and excludes $7,158 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 20.8%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Since inception, on 1/3/2013, the model gained 331.49% while the benchmark SPY gained 188.61% and the ETF USMV gained 164.17% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.81% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $431,769 which includes $834 cash and excludes $3,529 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.31% at a time when BND gained 0.20%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $145,931 which includes $2,899 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -14.2%, and for the last 12 months is -17.0%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of iM-Best(Short) gained -2.19% at a time when SPY gained 1.29%. Over the period 1/2/2009 to 11/30/2020 the starting capital of $100,000 would have grown to $69,060 which includes $123,596 cash and excludes $29,403 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.60% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $128,733 which includes $715 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.43% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $131,389 which includes $1,053 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is -4.8%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.28% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,220 which includes $603 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 20.0%, and for the last 12 months is 22.3%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -2.91% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $156,302 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -5.4%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was 14.1% and 17.4% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -1.03% at a time when SPY gained 1.29%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $106,491 which includes $2,229 cash and excludes $2,292 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.