|

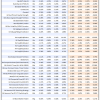

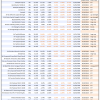

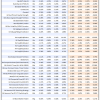

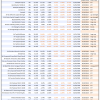

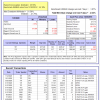

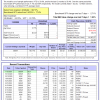

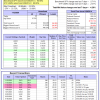

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

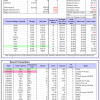

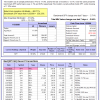

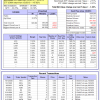

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 0.2%. Over the same period the benchmark E60B40 performance was 6.3% and 9.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.78% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $125,259 which includes $575 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.3%, and for the last 12 months is -1.4%. Over the same period the benchmark E60B40 performance was 6.3% and 9.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.04% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $125,650 which includes $429 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -7.2%, and for the last 12 months is -3.0%. Over the same period the benchmark E60B40 performance was 6.3% and 9.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.30% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $125,955 which includes $573 cash and excludes $2,045 spent on fees and slippage. |

|

|

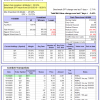

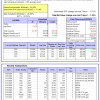

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 324.38% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -4.27% at a time when SPY gained -2.71%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,094 which includes $7,543 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 303.04% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -4.20% at a time when SPY gained -2.71%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $100,760 which includes $250 cash and excludes $683 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 65.53% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.17% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $165,530 which includes $973 cash and excludes $4,908 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 178.42% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.17% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $278,418 which includes $129 cash and excludes $2,970 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/8/2016, the model gained 284.74% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -1.17% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/8/2016 would have grown to $384,743 which includes $205 cash and excludes $1,492 spent on fees and slippage. |

|

|

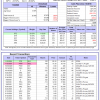

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 150.13% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.01% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $250,132 which includes $563 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 233.25% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.39% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $333,246 which includes $1,174 cash and excludes $4,865 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 96.98% while the benchmark SPY gained 77.63% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -3.44% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $196,977 which includes -$208 cash and excludes $6,354 spent on fees and slippage. |

|

|

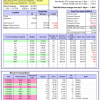

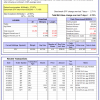

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.7%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.21% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $296,465 which includes $1,359 cash and excludes $5,720 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 33.9%, and for the last 12 months is 56.4%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.93% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$1,187 which includes $66,004 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -17.8%, and for the last 12 months is -13.1%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.84% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $582,713 which includes $570 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -14.5%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.29% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $151,464 which includes $4,735 cash and excludes $6,570 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of iM-Combo5 gained -3.44% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $150,945 which includes $1,173 cash and excludes $0 spent on fees and slippage. |

|

|

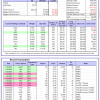

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 8.7%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Since inception, on 7/1/2014, the model gained 146.60% while the benchmark SPY gained 90.68% and VDIGX gained 85.52% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.64% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $246,598 which includes $1,401 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 0.8%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.20% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $168,625 which includes $121 cash and excludes $1,556 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -14.8%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Since inception, on 6/30/2014, the model gained 100.12% while the benchmark SPY gained 90.68% and the ETF USMV gained 90.80% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -4.28% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $200,124 which includes $384 cash and excludes $7,158 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Since inception, on 1/3/2013, the model gained 286.23% while the benchmark SPY gained 163.21% and the ETF USMV gained 147.92% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.36% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $386,228 which includes $4,759 cash and excludes $3,495 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.05% at a time when BND gained -0.15%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $141,623 which includes $2,899 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -5.1%, and for the last 12 months is -9.7%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of iM-Best(Short) gained 6.53% at a time when SPY gained -2.71%. Over the period 1/2/2009 to 11/2/2020 the starting capital of $100,000 would have grown to $76,309 which includes $138,497 cash and excludes $28,941 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.18% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,296 which includes $715 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.1%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.30% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,451 which includes $1,053 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -15.5%, and for the last 12 months is -10.8%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.70% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,966 which includes $603 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 11.6%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -3.44% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,368 which includes -$662 cash and excludes $5,636 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -7.2%. Over the same period the benchmark SPY performance was 4.1% and 9.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.83% at a time when SPY gained -2.71%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $101,849 which includes $1,377 cash and excludes $2,151 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.