|

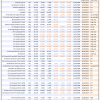

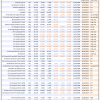

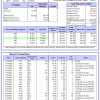

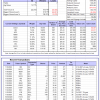

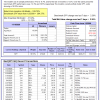

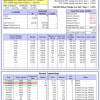

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 5.1%. Over the same period the benchmark E60B40 performance was 12.7% and 15.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.57% at a time when SPY gained 1.47%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $132,596 which includes $575 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 4.2%. Over the same period the benchmark E60B40 performance was 12.7% and 15.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.75% at a time when SPY gained 1.47%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $134,287 which includes $429 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 3.3%. Over the same period the benchmark E60B40 performance was 12.7% and 15.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.93% at a time when SPY gained 1.47%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $135,893 which includes $573 cash and excludes $2,045 spent on fees and slippage. |

|

|

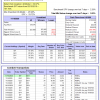

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 352.34% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.54% at a time when SPY gained 2.26%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $113,086 which includes $7,623 cash and excludes $1,085 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 323.66% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.30% at a time when SPY gained 2.26%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $105,916 which includes $250 cash and excludes $683 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 343.95% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $443,949 which includes $1,017 cash and excludes $5,754 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 78.78% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $178,779 which includes $131 cash and excludes $4,984 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 211.33% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $311,326 which includes $1,134 cash and excludes $3,242 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 334.74% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $434,742 which includes $327 cash and excludes $1,492 spent on fees and slippage. |

|

|

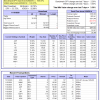

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 156.46% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.76% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $256,464 which includes $563 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 253.47% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $353,474 which includes -$391 cash and excludes $5,024 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 108.25% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $208,248 which includes $1,124 cash and excludes $6,431 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 158.64% while the benchmark SPY gained 95.04% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $258,640 which includes -$69 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 26.6%, and for the last 12 months is 27.1%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 5.15% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $318,935 which includes $2,434 cash and excludes $5,720 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 46.8%, and for the last 12 months is 82.6%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 2.09% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $34 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is -6.3%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.26% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $639,781 which includes $570 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -9.1%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.28% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $160,974 which includes $4,862 cash and excludes $6,575 spent on fees and slippage. |

|

|

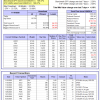

iM-Combo5: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 10.4%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of iM-Combo5 gained 1.82% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $164,970 which includes $2,205 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Since inception, on 7/1/2014, the model gained 167.62% while the benchmark SPY gained 109.37% and VDIGX gained 103.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.30% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $267,622 which includes $1,537 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 9.1%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 4.47% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $185,614 which includes $31,141 cash and excludes $1,592 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -7.6%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Since inception, on 6/30/2014, the model gained 117.10% while the benchmark SPY gained 109.37% and the ETF USMV gained 106.27% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 4.19% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $217,095 which includes $498 cash and excludes $7,158 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 21.1%, and for the last 12 months is 24.2%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Since inception, on 1/3/2013, the model gained 341.12% while the benchmark SPY gained 189.02% and the ETF USMV gained 168.01% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.34% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $441,123 which includes $127 cash and excludes $3,529 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.05% at a time when BND gained 0.30%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $145,269 which includes $2,899 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -13.5%, and for the last 12 months is -17.4%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of iM-Best(Short) gained -0.82% at a time when SPY gained 2.26%. Over the period 1/2/2009 to 11/16/2020 the starting capital of $100,000 would have grown to $69,338 which includes $112,831 cash and excludes $29,146 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 3.57% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,852 which includes $715 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 6.9%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 3.83% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $135,051 which includes $1,053 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.25% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,432 which includes $603 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 26.9%, and for the last 12 months is 29.8%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.05% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,190 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was 14.3% and 18.5% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.42% at a time when SPY gained 2.26%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $108,587 which includes -$319 cash and excludes $2,290 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.