|

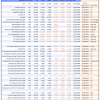

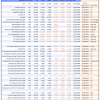

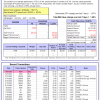

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

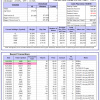

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 4.1%. Over the same period the benchmark E60B40 performance was 8.2% and 13.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.04% at a time when SPY gained 0.83%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $127,349 which includes $448 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 3.2%. Over the same period the benchmark E60B40 performance was 8.2% and 13.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.29% at a time when SPY gained 0.83%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $128,099 which includes $333 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 2.3%. Over the same period the benchmark E60B40 performance was 8.2% and 13.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.53% at a time when SPY gained 0.83%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $128,762 which includes $509 cash and excludes $2,045 spent on fees and slippage. |

|

|

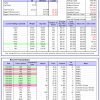

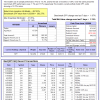

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 352.61% while the benchmark SPY gained 82.77% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.34% at a time when SPY gained 1.67%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $113,161 which includes $7,475 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 316.64% while the benchmark SPY gained 82.77% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.74% at a time when SPY gained 1.67%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $104,161 which includes $490 cash and excludes $667 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/8/2016, the model gained 293.58% while the benchmark SPY gained 82.77% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.00% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 1/8/2016 would have grown to $393,580 which includes $1,170 cash and excludes $1,472 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 161.89% while the benchmark SPY gained 82.77% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.39% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $261,891 which includes $159 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 213.73% while the benchmark SPY gained 82.77% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.21% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $313,735 which includes $181 cash and excludes $4,543 spent on fees and slippage. |

|

|

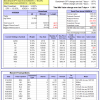

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.4%, and for the last 12 months is 25.0%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.77% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $295,880 which includes $1,064 cash and excludes $5,574 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 33.4%, and for the last 12 months is 85.7%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.68% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $665 which includes $62,785 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -15.3%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.74% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $600,404 which includes -$26,793 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.1%, and for the last 12 months is -10.0%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.65% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $155,693 which includes $1,874 cash and excludes $6,568 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 8.4%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of iM-Combo5 gained 1.15% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $156,874 which includes $1,007 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Since inception, on 7/1/2014, the model gained 153.76% while the benchmark SPY gained 96.20% and VDIGX gained 92.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.16% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $253,758 which includes $913 cash and excludes $3,635 spent on fees and slippage. |

|

|

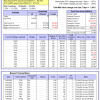

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.82% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $174,212 which includes $1,905 cash and excludes $1,396 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -10.5%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Since inception, on 6/30/2014, the model gained 110.29% while the benchmark SPY gained 96.20% and the ETF USMV gained 97.03% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.05% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $210,310 which includes $2,363 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Since inception, on 1/3/2013, the model gained 287.66% while the benchmark SPY gained 170.84% and the ETF USMV gained 155.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.31% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $387,659 which includes $4,327 cash and excludes $3,495 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.57% at a time when BND gained -0.43%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $142,255 which includes $2,304 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -13.9%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of iM-Best(Short) gained -3.08% at a time when SPY gained 1.67%. Over the period 1/2/2009 to 10/5/2020 the starting capital of $100,000 would have grown to $72,258 which includes $86,408 cash and excludes $28,716 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.0%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.35% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,477 which includes $715 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is -1.3%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 3.16% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,275 which includes $1,053 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -4.6%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.66% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,943 which includes $603 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 15.5%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.75% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,439 which includes -$662 cash and excludes $5,636 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.0%, and for the last 12 months is -4.9%. Over the same period the benchmark SPY performance was 7.1% and 17.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 2.52% at a time when SPY gained 1.67%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $102,499 which includes $1,318 cash and excludes $2,151 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.