- For what is considered to be a lagging indicator of the economy, the unemployment rate provides surprisingly good signals for the beginning and end of recessions.

- This model, backtested to 1948, reliably provided recession signals.

- The model, updated with the July 2019 rate of 3.7%, does not signal a recession.

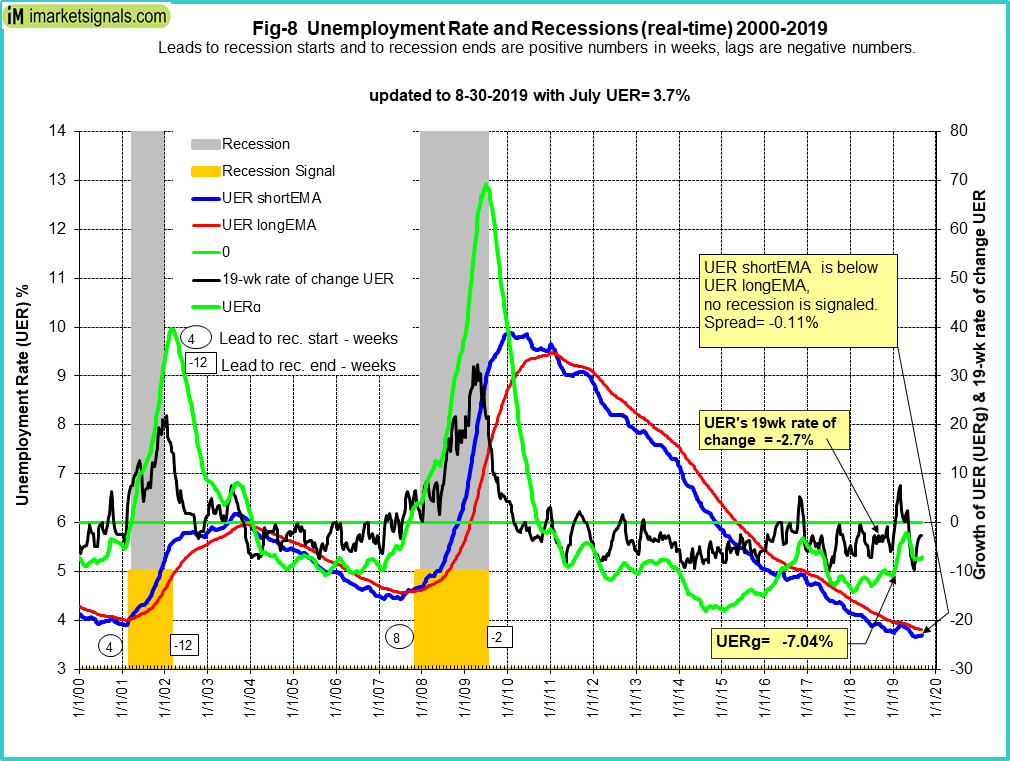

A reliable source for recession forecasting is the unemployment rate, which can provide signals for the beginning and end of recessions (Appendix B charts the UER recession indicator for the period 1948 to 2015). The unemployment rate model (article link) updated with the July 2019 rate of 3.7% does not signal a recession.

The model relies on four indicators to signal recessions:

- The short 12-period and a long 60-period exponential moving average (EMA) of the unemployment rate (UER).

- The eight-month smoothed annualized growth rate of the UER (UERg).

- The 19-week rate of change of the UER.

The criteria for the model to signal the start of recessions are given in the original article and repeated in the Appendix.

Referring to the chart below and looking at the end portion of it, one can see that none of the conditions for the start of a recession are currently present.

- The UER at 3.7% is unchangef grom last month. The short EMA is below its long EMA, the blue and red graphs, respectively, and the spread narrowed to minus 0.11%, last month’s minus 0.14%.

- UERg had formed a trough in 2015, peaked at minus 4.4% end 2016 and declined to minus 14.1% beginning 2018. After rising to minus 2.17% in April 2019 it is declining again, Now at minus 7.04%, which is above last month’s minus 7.45% – the green graph.

- Also, the 19-week rate of change of the UER increased to minus7%, is far from the critical level of plus 8% – the black graph.

For a recession signal, the short EMA of the UER would have to form a trough and then cross its long EMA to the upside. Alternatively, the UERg graph would have to turn upwards and rise above zero, or the 19-week rate of change of the UER would have to be above 8%.

Based on the historic patterns of the unemployment rate indicators prior to recessions, one can reasonably conclude that the U.S. economy is not heading into recession soon.

Appendix

The model signals the start of a recession when any one of the following three conditions occurs:

- The short exponential moving average (EMA) of the unemployment rate (UER) rises and crosses the long EMA to the upside, and the difference between the two EMAs is at least 0.07.

- The unemployment rate growth rate (UERg) rises above zero, while the long EMA of the unemployment rate has a positive slope, and the difference between the long EMA at that time and the long EMA 10 weeks before is greater than 0.025.

- The 19-week rate of change of the UER is greater than 8.0%, while simultaneously the long EMA of the UER has a positive slope and the difference between the long EMA at the time and the long EMA 10 weeks earlier is greater than 0.015.

Leave a Reply

You must be logged in to post a comment.