|

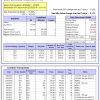

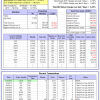

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

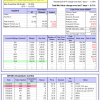

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 1.6%. Over the same period the benchmark E60B40 performance was 16.0% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.65% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $122,863 which includes -$468 cash and excludes $1,032 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.6%, and for the last 12 months is 0.6%. Over the same period the benchmark E60B40 performance was 16.0% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.65% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $124,866 which includes -$782 cash and excludes $1,158 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is -0.4%. Over the same period the benchmark E60B40 performance was 16.0% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.65% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $126,842 which includes -$982 cash and excludes $1,277 spent on fees and slippage. |

|

|

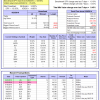

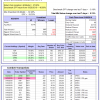

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.19% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $653,128 which includes -$5,021 cash and excludes $22,629 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is -1.6%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.50% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $172,739 which includes $6,383 cash and excludes $5,404 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of iM-Combo5 gained 0.11% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $145,557 which includes $1,572 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 21.5%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Since inception, on 7/1/2014, the model gained 122.83% while the benchmark SPY gained 68.94% and VDIGX gained 76.05% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.45% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $222,833 which includes $821 cash and excludes $2,655 spent on fees and slippage. |

|

|

iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 2.7%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of iM-Best7(HiD-LoV) gained -0.70% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,093 which includes $36,950 cash and excludes $3,342 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.83% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $156,607 which includes $1,811 cash and excludes $1,037 spent on fees and slippage. |

|

|

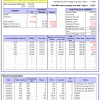

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 21.6%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Since inception, on 6/30/2014, the model gained 108.55% while the benchmark SPY gained 68.94% and the ETF USMV gained 91.27% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.67% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $208,552 which includes $665 cash and excludes $5,730 spent on fees and slippage. |

|

|

iM Min Volatility (USMV) Investor: The model’s out of sample performance YTD is 25.5%, and for the last 12 months is 13.1%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Since inception, on 1/3/2013, the model gained 260.67% while the benchmark SPY gained 133.20% and the ETF USMV gained 148.32% over the same period. Over the previous week the market value of iM Min Volatility (USMV) Investor gained 0.43% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $360,666 which includes -$2,194 cash and excludes $2,156 spent on fees and slippage. |

|

|

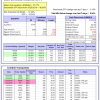

iM-Best(Short): The model’s out of sample performance YTD is -6.6%, and for the last 12 months is -1.8%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of iM-Best(Short) gained 0.22% at a time when SPY gained -0.19%. Over the period 1/2/2009 to 9/23/2019 the starting capital of $100,000 would have grown to $83,169 which includes $115,023 cash and excludes $26,277 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 14.1%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.88% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,986 which includes $428 cash and excludes $673 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 17.2%, and for the last 12 months is 11.4%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.85% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $126,605 which includes $1,194 cash and excludes $00 spent on fees and slippage. |

|

|

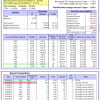

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 19.6%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -0.67% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,622 which includes $6,395 cash and excludes $513 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.19% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,777 which includes $1,970 cash and excludes $3,393 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -8.2%, and for the last 12 months is -30.1%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.07% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,995 which includes $327 cash and excludes $7,434 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.73% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,255 which includes $545 cash and excludes $3,389 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 2.8%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.07% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $108,562 which includes $80 cash and excludes $1,320 spent on fees and slippage. |

|

|

iM-Min Drawdown Combo: The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.01% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $116,880 which includes $13,307 cash and excludes $1,360 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 6.6%, and for the last 12 months is -23.9%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.74% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $147,658 which includes $142 cash and excludes $3,569 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 8.9%, and for the last 12 months is -7.2%. Over the same period the benchmark SPY performance was 21.0% and 4.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.94% at a time when SPY gained -0.19%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $127,774 which includes $353 cash and excludes $3,330 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.