|

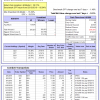

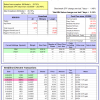

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 2.0%. Over the same period the benchmark E60B40 performance was 13.5% and 5.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.07% at a time when SPY gained -0.75%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $122,592 which includes -$637 cash and excludes $1,032 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 1.2%. Over the same period the benchmark E60B40 performance was 13.5% and 5.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.07% at a time when SPY gained -0.75%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $124,589 which includes -$955 cash and excludes $1,158 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 9.2%, and for the last 12 months is 0.5%. Over the same period the benchmark E60B40 performance was 13.5% and 5.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.07% at a time when SPY gained -0.75%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $126,559 which includes -$1,157 cash and excludes $1,277 spent on fees and slippage. |

|

|

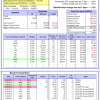

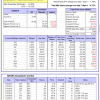

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.50% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $627,541 which includes -$8,075 cash and excludes $22,629 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 6.1%, and for the last 12 months is -4.9%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.27% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $164,594 which includes $5,743 cash and excludes $5,400 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is -2.6%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of iM-Combo5 gained -1.81% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $139,312 which includes $3,599 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 18.6%, and for the last 12 months is 12.7%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Since inception, on 7/1/2014, the model gained 117.48% while the benchmark SPY gained 62.40% and VDIGX gained 72.68% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.12% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $217,479 which includes $956 cash and excludes $2,647 spent on fees and slippage. |

|

|

iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of iM-Best7(HiD-LoV) gained -1.04% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,406 which includes $475 cash and excludes $3,211 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.29% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $152,034 which includes $1,051 cash and excludes $1,037 spent on fees and slippage. |

|

|

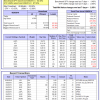

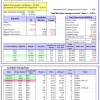

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 20.0%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Since inception, on 6/30/2014, the model gained 105.72% while the benchmark SPY gained 62.40% and the ETF USMV gained -100.00% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.65% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $205,724 which includes $1,241 cash and excludes $5,768 spent on fees and slippage. |

|

|

iM Min Volatility (USMV) Investor: The model’s out of sample performance YTD is 22.2%, and for the last 12 months is 13.1%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Since inception, on 1/3/2013, the model gained 251.26% while the benchmark SPY gained 124.18% and the ETF USMV gained -100.00% over the same period. Over the previous week the market value of iM Min Volatility (USMV) Investor gained -0.90% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $351,264 which includes $1,091 cash and excludes $2,152 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -8.7%, and for the last 12 months is -8.3%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of iM-Best(Short) gained 0.14% at a time when SPY gained -1.48%. Over the period 1/2/2009 to 8/26/2019 the starting capital of $100,000 would have grown to $81,259 which includes $114,144 cash and excludes $26,208 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.70% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,267 which includes $67 cash and excludes $672 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 13.4%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.53% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,568 which includes $1,069 cash and excludes $00 spent on fees and slippage. |

|

|

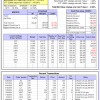

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is -1.1%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -1.71% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $136,550 which includes $5,737 cash and excludes $513 spent on fees and slippage. |

|

|

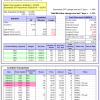

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 9.7%, and for the last 12 months is 7.0%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.54% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,894 which includes -$2,426 cash and excludes $3,090 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -7.2%, and for the last 12 months is -28.6%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -6.75% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $167,874 which includes $2,484 cash and excludes $7,101 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.51% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,801 which includes -$1,537 cash and excludes $3,140 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.11% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,368 which includes -$938 cash and excludes $1,102 spent on fees and slippage. |

|

|

iM-Min Drawdown Combo: The model’s out of sample performance YTD is 12.6%, and for the last 12 months is 3.5%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.72% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $114,827 which includes $400 cash and excludes $1,208 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 5.7%, and for the last 12 months is -22.8%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -2.00% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $146,392 which includes -$407 cash and excludes $3,036 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 7.3%, and for the last 12 months is -6.7%. Over the same period the benchmark SPY performance was 16.3% and 2.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -1.19% at a time when SPY gained -1.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $125,888 which includes -$14 cash and excludes $2,872 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.