|

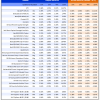

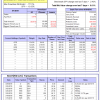

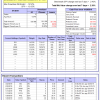

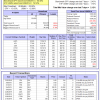

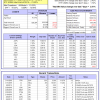

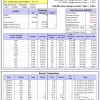

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

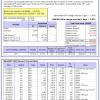

| iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 6.7%. Over the same period the benchmark SPY performance was 9.9% and 8.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.41% at a time when SPY gained 1.37%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $120,109 which includes $428 cash and excludes $788 spent on fees and slippage. | |

| iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 7.9%, and for the last 12 months is 7.4%. Over the same period the benchmark SPY performance was 9.9% and 8.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.36% at a time when SPY gained 1.37%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $122,900 which includes $586 cash and excludes $909 spent on fees and slippage. | |

| iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 9.9% and 8.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.36% at a time when SPY gained 1.37%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $125,627 which includes $683 cash and excludes $1,024 spent on fees and slippage. | |

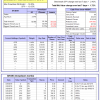

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.48% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $619,592 which includes -$11,234 cash and excludes $22,629 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 2.3%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.19% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $158,581 which includes -$2,546 cash and excludes $5,182 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of iM-Combo5 gained 1.46% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $135,704 which includes -$343 cash and excludes $0 spent on fees and slippage. | |

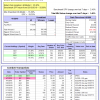

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.8%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Since inception, on 7/1/2014, the model gained 105.01% while the benchmark SPY gained 60.40% and VDIGX gained 61.32% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.56% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $205,015 which includes $181 cash and excludes $2,508 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.01% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,102 which includes $36,169 cash and excludes $2,882 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 11.6%, and for the last 12 months is 11.7%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.39% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $168,104 which includes $2,214 cash and excludes $870 spent on fees and slippage. | |

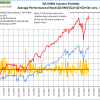

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 19.4%, and for the last 12 months is 18.4%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Since inception, on 6/30/2014, the model gained 104.79% while the benchmark SPY gained 60.40% and the ETF USMV gained 74.52% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.12% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $204,790 which includes $1,120 cash and excludes $5,230 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 18.0%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Since inception, on 1/5/2015, the model gained 94.03% while the benchmark SPY gained 54.14% and the ETF USMV gained 60.27% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.21% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $194,025 which includes $948 cash and excludes $1,442 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Since inception, on 3/30/2015, the model gained 64.56% while the benchmark SPY gained 48.64% and the ETF USMV gained 54.80% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.60% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $164,565 which includes -$229 cash and excludes $1,310 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Since inception, on 7/1/2014, the model gained 97.47% while the benchmark SPY gained 60.40% and the ETF USMV gained 74.52% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.91% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $197,465 which includes $90 cash and excludes $1,917 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 108.94% while the benchmark SPY gained 57.98% and the ETF USMV gained 72.11% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.68% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $208,940 which includes $150 cash and excludes $1,723 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 53.95% over SPY. (see iM-USMV Investor Portfolio) | |

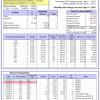

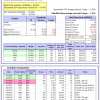

| iM-Best(Short): The model’s out of sample performance YTD is -12.3%, and for the last 12 months is -16.6%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of iM-Best(Short) gained -1.10% at a time when SPY gained 2.43%. Over the period 1/2/2009 to 4/1/2019 the starting capital of $100,000 would have grown to $78,059 which includes $78,059 cash and excludes $25,545 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.15% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,653 which includes $307 cash and excludes $558 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 9.2%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.22% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $117,993 which includes $688 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 15.6%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.86% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,916 which includes $5,116 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.43% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,703 which includes $499 cash and excludes $2,780 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.70% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $203,869 which includes $712 cash and excludes $5,147 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is -5.3%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 3.89% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,992 which includes $258 cash and excludes $2,889 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.61% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $104,190 which includes $1,010 cash and excludes $675 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 11.3%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.72% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $113,479 which includes $11,762 cash and excludes $948 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 8.4%, and for the last 12 months is -6.3%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 4.73% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $150,049 which includes $285 cash and excludes $2,795 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 0.2%. Over the same period the benchmark SPY performance was 14.9% and 10.7% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.16% at a time when SPY gained 2.43%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $124,788 which includes -$316 cash and excludes $2,670 spent on fees and slippage. |

iM-Best Reports – 4/1/2019

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.