|

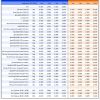

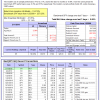

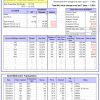

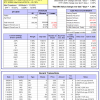

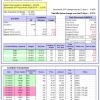

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was 5.4% and 5.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.07% at a time when SPY gained -0.15%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $115,451 which includes $37 cash and excludes $672 spent on fees and slippage. | |

| iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 5.4% and 5.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.10% at a time when SPY gained -0.15%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $117,749 which includes $16 cash and excludes $766 spent on fees and slippage. | |

| iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 3.5%, and for the last 12 months is 4.8%. Over the same period the benchmark SPY performance was 5.4% and 5.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.13% at a time when SPY gained -0.15%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $120,052 which includes -$21 cash and excludes $857 spent on fees and slippage. | |

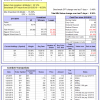

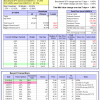

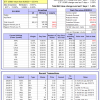

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 10.9%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.59% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $614,191 which includes $9 cash and excludes $21,417 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 0.3%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.59% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $156,546 which includes -$2,381 cash and excludes $4,868 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 3.1%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of iM-Combo5 gained 0.36% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $130,118 which includes -$329 cash and excludes $1,457 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Since inception, on 7/1/2014, the model gained 96.27% while the benchmark SPY gained 51.20% and VDIGX gained 51.06% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.74% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $196,269 which includes $616 cash and excludes $2,461 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.98% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,763 which includes $645 cash and excludes $2,681 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.80% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $160,008 which includes $1,265 cash and excludes $870 spent on fees and slippage. | |

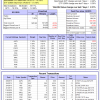

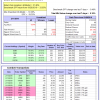

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Since inception, on 6/30/2014, the model gained 93.47% while the benchmark SPY gained 51.20% and the ETF USMV gained 65.19% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.80% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $193,472 which includes $275 cash and excludes $5,136 spent on fees and slippage. | |

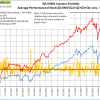

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Since inception, on 1/5/2015, the model gained 82.75% while the benchmark SPY gained 45.30% and the ETF USMV gained 51.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.21% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $182,746 which includes $566 cash and excludes $1,442 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Since inception, on 3/30/2015, the model gained 55.45% while the benchmark SPY gained 40.11% and the ETF USMV gained 46.52% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.49% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $155,451 which includes -$457 cash and excludes $1,310 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 8.4%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Since inception, on 7/1/2014, the model gained 87.02% while the benchmark SPY gained 51.20% and the ETF USMV gained 65.19% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.28% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $187,024 which includes $548 cash and excludes $1,894 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 96.49% while the benchmark SPY gained 48.91% and the ETF USMV gained 62.91% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.48% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $196,489 which includes -$135 cash and excludes $1,723 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 50.98% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -9.1%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of iM-Best(Short) gained 0.32% at a time when SPY gained -0.49%. Over the period 1/2/2009 to 2/11/2019 the starting capital of $100,000 would have grown to $80,888 which includes $80,888 cash and excludes $25,378 spent on fees and slippage. | |

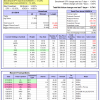

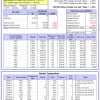

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 3.2%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.50% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,807 which includes $313 cash and excludes $447 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 9.9%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.06% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,969 which includes -$20 cash and excludes $00 spent on fees and slippage. | |

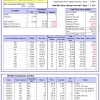

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.04% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $132,542 which includes $4,511 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is 11.2%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.55% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,299 which includes $1,053 cash and excludes $2,486 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 13.0%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.56% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $188,843 which includes $416 cash and excludes $4,763 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is -11.7%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.05% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $114,678 which includes $210 cash and excludes $2,651 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.22% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $100,100 which includes $964 cash and excludes $472 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 2.8%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.13% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $109,126 which includes $3,137 cash and excludes $792 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 2.6%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.27% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $142,091 which includes $339 cash and excludes $2,282 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 8.3% and 5.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.18% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $121,457 which includes $417 cash and excludes $2,083 spent on fees and slippage. |

iM-Best Reports – 2/11/2019

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.