|

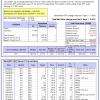

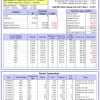

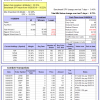

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 13.0%. Over the same period the benchmark E60B40 performance was 19.8% and 17.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.58% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $127,036 which includes $30 cash and excludes $1,278 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 13.9%, and for the last 12 months is 13.4%. Over the same period the benchmark E60B40 performance was 19.8% and 17.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.59% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $129,755 which includes -$115 cash and excludes $1,408 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 13.7%. Over the same period the benchmark E60B40 performance was 19.8% and 17.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.60% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $132,463 which includes -$124 cash and excludes $1,531 spent on fees and slippage. |

|

|

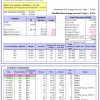

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 22.1%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.44% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $686,586 which includes -$5,021 cash and excludes $22,629 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.15% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $173,790 which includes $4,424 cash and excludes $5,516 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 17.9%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of iM-Combo5 gained 0.33% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $150,139 which includes $2,084 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 29.0%, and for the last 12 months is 23.9%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Since inception, on 7/1/2014, the model gained 136.70% while the benchmark SPY gained 77.53% and VDIGX gained 78.95% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.22% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $236,705 which includes $418 cash and excludes $2,727 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 9.0%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.97% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $171,118 which includes $1,350 cash and excludes $1,118 spent on fees and slippage. |

|

|

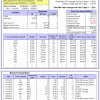

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 33.3%, and for the last 12 months is 26.7%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Since inception, on 6/30/2014, the model gained 128.61% while the benchmark SPY gained 77.53% and the ETF USMV gained 92.06% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.24% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $228,609 which includes $415 cash and excludes $5,981 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 23.1%, and for the last 12 months is 20.6%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Since inception, on 1/3/2013, the model gained 253.94% while the benchmark SPY gained 145.06% and the ETF USMV gained 149.36% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.16% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $353,943 which includes $1,300 cash and excludes $2,291 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 10.0%, and for the last 12 months is -1.5%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.21% at a time when BND gained 0.37%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $145,949 which includes $4,390 cash and excludes $1,985 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.2%, and for the last 12 months is -4.6%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of iM-Best(Short) gained -1.70% at a time when SPY gained 0.43%. Over the period 1/2/2009 to 11/25/2019 the starting capital of $100,000 would have grown to $82,650 which includes $99,341 cash and excludes $26,649 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 6.9%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.30% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,047 which includes $70 cash and excludes $674 spent on fees and slippage. |

|

|

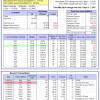

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 13.7%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.42% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,986 which includes $282 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 24.3%, and for the last 12 months is 16.5%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.50% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,352 which includes $6,395 cash and excludes $513 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 18.7%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.43% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,342 which includes $1,970 cash and excludes $3,393 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is -6.0%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.26% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,872 which includes $327 cash and excludes $7,434 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 16.4%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.34% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,741 which includes $438 cash and excludes $4,007 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 14.9%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.46% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $110,704 which includes $742 cash and excludes $1,466 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 10.0%, and for the last 12 months is -1.5%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.72% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $152,352 which includes $737 cash and excludes $3,569 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 12.6%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was 27.1% and 21.4% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.01% at a time when SPY gained 0.43%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $132,045 which includes $760 cash and excludes $3,330 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.