|

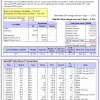

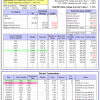

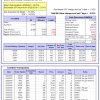

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

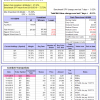

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 8.0%. Over the same period the benchmark E60B40 performance was 18.2% and 12.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.00% at a time when SPY gained -0.08%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $125,249 which includes $30 cash and excludes $1,278 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 7.7%. Over the same period the benchmark E60B40 performance was 18.2% and 12.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.08% at a time when SPY gained -0.08%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $127,815 which includes -$115 cash and excludes $1,408 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 7.5%. Over the same period the benchmark E60B40 performance was 18.2% and 12.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.15% at a time when SPY gained -0.08%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $130,369 which includes -$124 cash and excludes $1,531 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 13.9%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.32% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $675,507 which includes -$5,021 cash and excludes $22,629 spent on fees and slippage. |

|

|

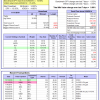

iM-Combo3.R1: The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 8.7%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.21% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $170,921 which includes $4,424 cash and excludes $5,516 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 15.7%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of iM-Combo5 gained -0.51% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $147,322 which includes $2,026 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 24.6%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Since inception, on 7/1/2014, the model gained 128.46% while the benchmark SPY gained 74.68% and VDIGX gained 76.45% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.89% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $228,459 which includes -$2 cash and excludes $2,727 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 11.5%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.49% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $167,972 which includes $1,350 cash and excludes $1,118 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 30.4%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Since inception, on 6/30/2014, the model gained 123.56% while the benchmark SPY gained 74.68% and the ETF USMV gained 89.26% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.12% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $223,557 which includes $3,045 cash and excludes $5,898 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 22.4%, and for the last 12 months is 11.4%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Since inception, on 1/3/2013, the model gained 251.88% while the benchmark SPY gained 141.14% and the ETF USMV gained 145.71% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.74% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $351,879 which includes $11 cash and excludes $2,215 spent on fees and slippage. |

|

|

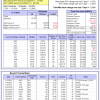

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 7.8%, and for the last 12 months is -13.3%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.93% at a time when SPY gained -0.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $4,390 which includes $1,985 cash and excludes $1,985 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -4.4%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of iM-Best(Short) gained -0.01% at a time when SPY gained 0.32%. Over the period 1/2/2009 to 11/11/2019 the starting capital of $100,000 would have grown to $85,124 which includes $118,707 cash and excludes $26,594 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 1.9%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.02% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,461 which includes $68 cash and excludes $674 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 15.4%, and for the last 12 months is 10.2%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.50% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,720 which includes $282 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 22.7%, and for the last 12 months is 10.8%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.09% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,455 which includes $6,395 cash and excludes $513 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 10.9%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.31% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $155,837 which includes $1,970 cash and excludes $3,393 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is -12.2%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.86% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $174,781 which includes $327 cash and excludes $7,434 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.38% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,264 which includes $730 cash and excludes $3,886 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.53% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $109,400 which includes $742 cash and excludes $1,466 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 7.8%, and for the last 12 months is -13.3%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.40% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $149,333 which includes $737 cash and excludes $3,569 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 11.1%, and for the last 12 months is -0.5%. Over the same period the benchmark SPY performance was 25.1% and 13.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.22% at a time when SPY gained 0.32%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $130,248 which includes $760 cash and excludes $3,330 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.