|

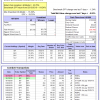

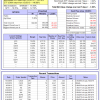

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

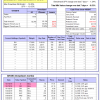

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 2.5%. Over the same period the benchmark E60B40 performance was 15.2% and 7.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.52% at a time when SPY gained -0.52%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $121,946 which includes $22 cash and excludes $1,278 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 1.3%. Over the same period the benchmark E60B40 performance was 15.2% and 7.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.70% at a time when SPY gained -0.52%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $123,701 which includes -$122 cash and excludes $1,408 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 8.2%, and for the last 12 months is 0.2%. Over the same period the benchmark E60B40 performance was 15.2% and 7.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.88% at a time when SPY gained -0.52%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $125,424 which includes -$128 cash and excludes $1,531 spent on fees and slippage. |

|

|

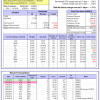

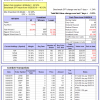

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.25% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $641,806 which includes -$5,021 cash and excludes $22,629 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 11.1%, and for the last 12 months is 0.0%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.19% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $172,270 which includes $2,184 cash and excludes $5,514 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 13.1%, and for the last 12 months is 1.5%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of iM-Combo5 gained -0.52% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $144,046 which includes $677 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Since inception, on 7/1/2014, the model gained 117.37% while the benchmark SPY gained 66.03% and VDIGX gained 74.07% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.71% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $217,371 which includes $258 cash and excludes $2,657 spent on fees and slippage. |

|

|

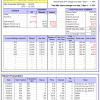

The iM-Best7(HiD-LoV) model sold all its position and is 100% in cash. As the model could not find any stock that fulfil its selection criteria, we take this as an opportune time to deprecate Best7(HiD-LoV) and the associated iM-Min-Drawdown-Combo. Going forward, we will no longer report on these two models.

iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of iM-Best7(HiD-LoV) gained 0.66% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,251 which includes $125,251 cash and excludes $3,452 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is -6.2%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.36% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,763 which includes $1,811 cash and excludes $1,037 spent on fees and slippage. |

|

|

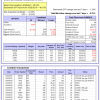

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 21.4%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Since inception, on 6/30/2014, the model gained 108.21% while the benchmark SPY gained 66.03% and the ETF USMV gained 90.15% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.03% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $208,209 which includes $1,041 cash and excludes $5,792 spent on fees and slippage. |

|

|

iM Min Volatility (USMV) Investor: The model’s out of sample performance YTD is 23.9%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Since inception, on 1/3/2013, the model gained 256.26% while the benchmark SPY gained 129.19% and the ETF USMV gained 146.88% over the same period. Over the previous week the market value of iM Min Volatility (USMV) Investor gained -1.56% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $356,263 which includes -$1,951 cash and excludes $2,156 spent on fees and slippage. |

|

|

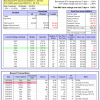

iM-Best(Short): The model’s out of sample performance YTD is -5.8%, and for the last 12 months is -1.7%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.65% at a time when SPY gained -1.24%. Over the period 1/2/2009 to 10/7/2019 the starting capital of $100,000 would have grown to $83,863 which includes $83,863 cash and excludes $26,382 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 5.5%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.75% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,972 which includes $698 cash and excludes $673 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 16.9%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.86% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $126,341 which includes $1,911 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 16.7%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -2.06% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,168 which includes $6,395 cash and excludes $513 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 1.9%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.23% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,217 which includes $1,970 cash and excludes $3,393 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -11.5%, and for the last 12 months is -30.1%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -3.28% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,938 which includes $327 cash and excludes $7,434 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 4.8%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.12% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,283 which includes -$137 cash and excludes $3,640 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -1.12% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $107,324 which includes $163 cash and excludes $1,320 spent on fees and slippage. |

|

|

The iM-Best7(HiD-LoV) model sold all its position and is 100% in cash. As the model could not find any stock that fulfil its selection criteria, we take this as an opportune time to deprecate Best7(HiD-LoV) and the associated iM-Min-Drawdown-Combo. Going forward, we will no longer report on these two models.

iM-Min Drawdown Combo: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.53% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $116,229 which includes $40,717 cash and excludes $1,390 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 4.4%, and for the last 12 months is -22.3%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -1.02% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $144,557 which includes $737 cash and excludes $3,569 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 7.7%, and for the last 12 months is -6.4%. Over the same period the benchmark SPY performance was 18.9% and 3.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.70% at a time when SPY gained -1.24%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $126,325 which includes $760 cash and excludes $3,330 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.