12/1/2018: Vanguard Systems

System1a uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination, echoing the broad based Index approach. Best for the investors that do not want to give too much attention to their investments.

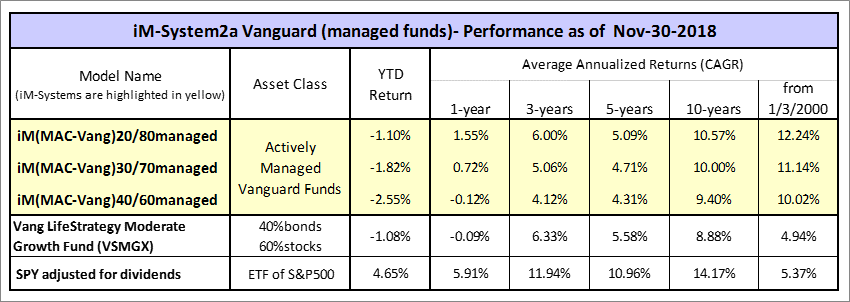

System2a uses six actively managed Vanguard funds with allocations optimized to produce the highest long-term return. Over the last 5 years this system has under-performed System1a and System3a.

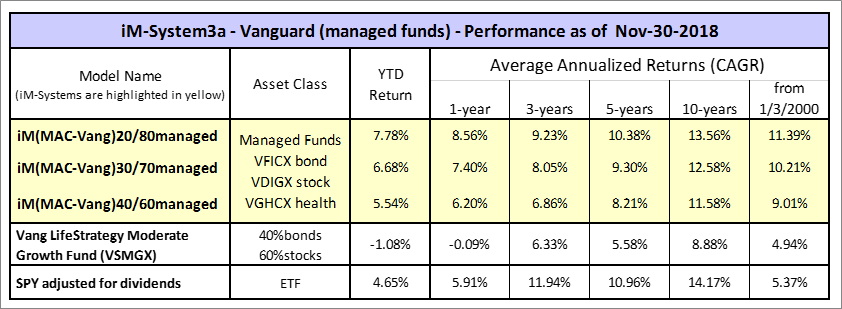

System3a uses three actively managed Vanguard funds with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund.

12/1/2018: Vanguard+TIAA Systems

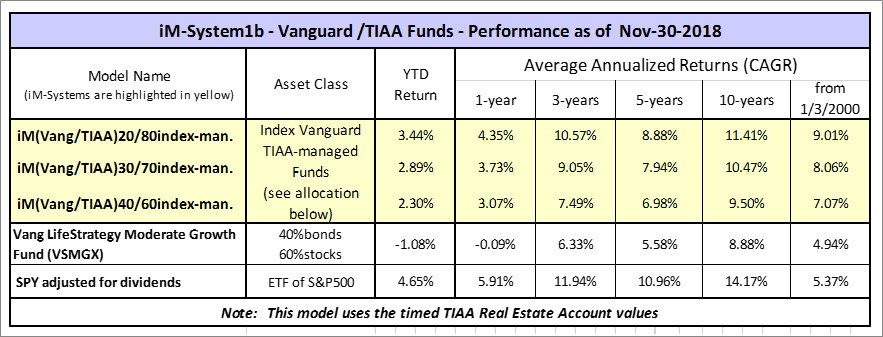

System1b uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination with TIAA Real Estate-timed (TIAAreal-timed), echoing the broad based Index approach but including TIAAreal-timed to reduce risk. System1b can be directly compared to System1a which does not include TIAAreal-timed. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

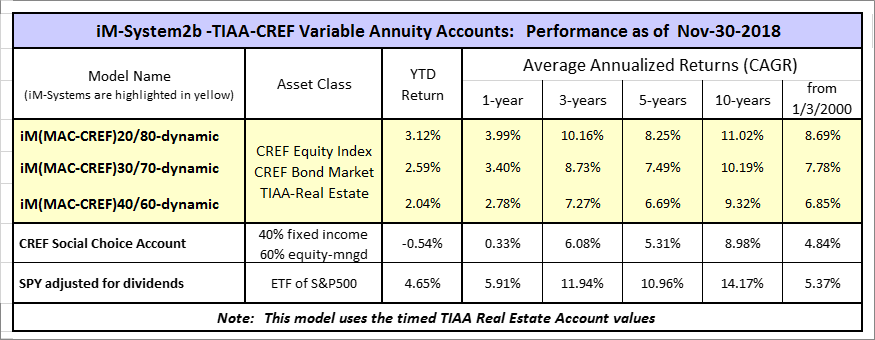

System2b is similar to System1b but uses the CREF Bond Market Account and CREF Equity Index Account instead of the Vanguard Total Bond Market Index Fund and Total Stock Market Index Fund. One can see that System2b has marginally lower returns and higher risk measurements than System1b, which would one lead to conclude that the Vanguard index funds are preferable to the CREF funds. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

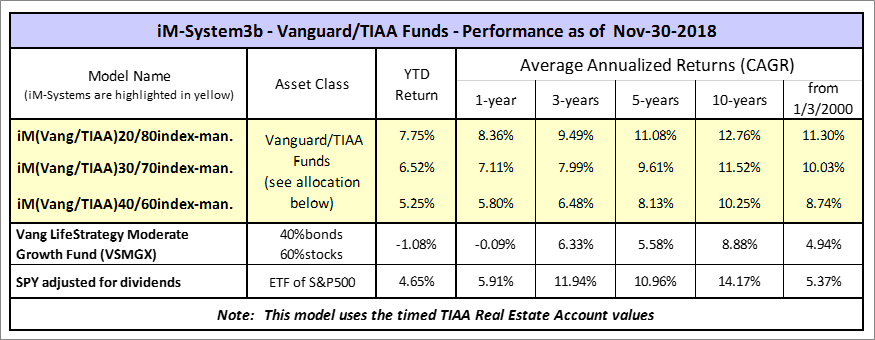

System3b uses the Vanguard Total Bond Market Index Fund and three actively managed Vanguard stock funds in combination with TIAAreal-timed, with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

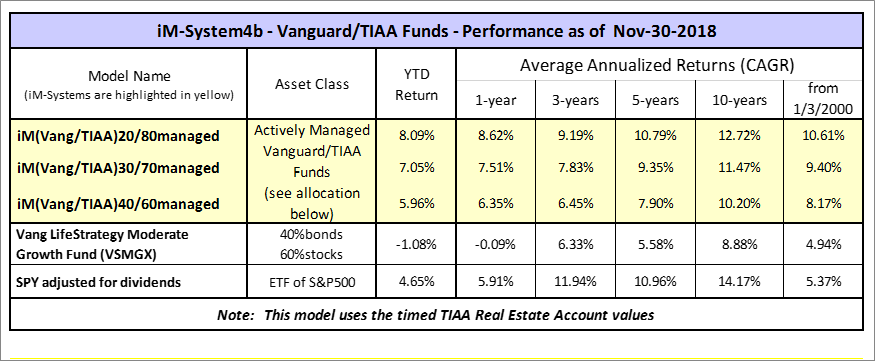

System4b is similar to System3a but uses the Vanguard Short-Term Investment-Grade Fund (VFSTX) instead of the Vanguard Total Bond Market Index Fund. Including the short-term bond fund reduces historic returns, but this system may be more appropriate for periods when rising interest rates are expected.

Will your recommended percentages for funds fluctuate withing an up or a down market? Obviously if the market goes down I would expect a drastic change from stock to bond allocation but, for example, if the market stays up for several months will the percentages still change slightly month to month based on your mathematical models? Also, is there a specific day of the month that you update this page? Thanks!

Up and down market periods are indicated by the MAC-US model. Currently this model still indicates an up market. If MAC-US signals a down market then the allocation to bonds increases. For example, for an up market allocation 60% stocks and 40% bonds, the allocation for a down market changes to 40% stocks and 60% bonds.

For long up market or down market periods the allocation changes a bit over time and we re-balance to nominal allocation at the end of December every year.

We update this page monthly a few days after the month end values of the component funds are known.

On Aug-27-2015 the MAC-US model generated a sell signal. As a result all the Vanguard/TIAA-CREF Systems changed to down-market asset allocations.

Hi Georg, Perhaps I’m reading this incorrectly but when I look at System 1…the “normal” 40/60 bonds/stocks is the most conservative of the three allocations. With the recent MAC system signal that allocation was reversed to 62/38. But now that is the most aggressive of the three allocations. Is that right?

The normal up-market allocation is 40%bonds and 60%stocks.

After the recent MAC-US switch, indicating a down-market, the allocation becomes 60%bonds and 40%stocks. That would be the most aggressive stock allocation of the three models in System-1.

Is this for 12/31 or still November??

It is what is says — today, 1/8/2016, we updated to 12/31/2015

Thanks, earlier it was posting 11/30 when the Best models were 12/31

Hello, I emailed this question, but I’ll try again here. Apologies for the duplication. At what level do I need to subscribe to get the signal for upmarket or down market for TIAA CREF? Is it held up a week or can I get it in real time? Thanks!

One needs to be a bronze member to get the allocations in real time. Otherwise the signals are delayed by 4 weeks, for people who want them for free.

The MAC-US model generated a buy-signal 4/5/16, however the sell-spread was not above zero and you advised staying in cash with the nominal asset allocation for the down market condition iM-Sys1a(MAC-VANG)20/80index =VBMFX 80% VTSMX 20%.

With todays email 4/22/16 of the market signals summary the MAC-US model is still on a buy signal and now the sell-spread is above zero and you’re still showing the iM-MAC US is in cash, hence: asset allocation for the down market condition.

At this point, now what conditions would have to exist for the model to indicate an up-market asset allocation and how close are we to that signal?

Thanks

I’m also interested in the answer to teammaui’s question.

ditto

We report the performance of the models monthly at the end of the month. The end of April-2016 update is now for up-market conditions, because the MAC-US signals an up-market now.

Are you able to provide Annual Returns both Actual and Backtest in addition to the current Performance numbers?

Thanks

The performance reports are similar to the standard report format for mutual funds. Additionally we provide risk measurements which one does not get from mutual fund providers.

Currently we do not provided calendar year performance figures.

Ditto to the above questions

any plans to implement these models into a robo-advisor format?

how do you purchase a membership level, do you wait until the trial period is over?

found it; I’m interested in the 3b model, can I see the signals for this model in the Bronze membership and if so how?

These models are updated at the end of the month and are available to all membership levels, including Bronze.

On the Home page click on “iM System Performance”(top right hand corner) to get to the models.

Hey Guys,

On what date did the iM Vanguard System 1A switch to 20/80 allocation and why is the model performance showing ytd returns for Nov 30 instead of Nov 26? Could you please clarify.

We are long time subscribers and have asked similar questions before and Georg has mentioned that according to Mac-US timer rules, that model, signaled a trade effective Nov 26 and since the Vang system allocation change is generated by the MAC timer we are suppose to change allocation of the mutual funds the day the Mac signal occurs i.e. Nov 26.

You mentioned that you report the performance of the models monthly at the end of the month but reporting monthly performance is not the same as what is the rule for what day do we make the trade.

So we were wondering since you mentioned over the years that we are suppose to change allocation of the mutual funds and do the switches on the day when the MAC signals are generated, why was System 1a performance showing a Nov 30 ytd 3.44% instead of a Nov 26 ytd -1.09 or do you mean we are to switch allocations and do the adjustment based on the Mac signal on the last day of every month?

Thank you for your input as we were wondering which rule to follow to get the performance results of the models.

I was wondering what the results would be if you used Vanguard Wellington (VWELX) for bull market and Vanguard Wellesley (VWINX) for bear market.

Thanks.

Tom C