|

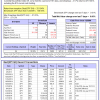

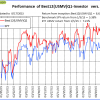

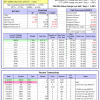

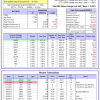

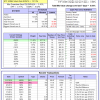

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 161 days, and showing a -3.17% return to 8/17/2015. Over the previous week the market value of Best(SPY-SH) gained 0.00% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $351,835 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 291 days, and showing a 8.21% return to 8/17/2015. Over the previous week the market value of iM-Combo3 gained 0.54% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,981 which includes $3,931 cash and excludes $1,243 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 6 of them winners, so far held for an average period of 245 days, and showing a 16.66% return to 8/17/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.75% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $474,186 which includes $953 cash and excludes $4,683 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 8 of them winners, so far held for an average period of 165 days, and showing a 8.62% return to 8/17/2015. Since inception, on 7/1/2014, the model gained 25.68% while the benchmark SPY gained 9.66% and the ETF VDIGX gained 9.98% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.07% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $125,682 which includes -$429 cash and excludes $527 spent on fees and slippage. | |

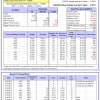

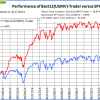

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 4 of them winners, so far held for an average period of 10 days, and showing a -1.48% return to 8/17/2015. Over the previous week the market value of iM-Best10 gained 0.37% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $809,547 which includes -$121 cash and excludes $75,281 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 4 of them winners, so far held for an average period of 27 days, and showing a 0.74% return to 8/17/2015. Over the previous week the market value of iM-Best3x4 gained 0.36% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $101,356 which includes $486 cash and excludes $113 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 4 stocks, 3 of them winners, so far held for an average period of 24 days, and showing a 0.78% return to 8/17/2015. Over the previous week the market value of iM-Best2x4 gained 1.94% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $102,575 which includes $391 cash and excludes $89 spent on fees and slippage. | |

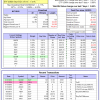

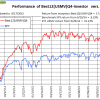

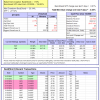

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 9 of them winners, so far held for an average period of 64 days, and showing a -0.74% return to 8/17/2015. Since inception, on 7/1/2014, the model gained 28.87% while the benchmark SPY gained 9.66% and the ETF USMV gained 16.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.22% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $128,873 which includes $152 cash and excludes $1,259 spent on fees and slippage. | |

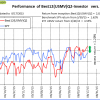

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 167 days, and showing a 4.60% return to 8/17/2015. Since inception, on 1/5/2015, the model gained 8.62% while the benchmark SPY gained 5.38% and the ETF USMV gained 7.21% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.66% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $108,622 which includes $262 cash and excludes $210 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 13 stocks, 10 of them winners, so far held for an average period of 120 days, and showing a -2.42% return to 8/17/2015. Since inception, on 3/31/2015, the model gained 2.82% while the benchmark SPY gained 1.62% and the ETF USMV gained 3.55% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.58% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $102,818 which includes $8,441 cash and excludes $121 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 45 days, and showing a 0.79% return to 8/17/2015. Since inception, on 7/1/2014, the model gained 22.89% while the benchmark SPY gained 9.66% and the ETF USMV gained 16.74% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.06% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,894 which includes $246 cash and excludes $408 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 275 days, and showing a 12.52% return to 8/17/2015. Since inception, on 9/30/2014, the model gained 17.46% while the benchmark SPY gained 8.19% and the ETF USMV gained 15.13% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.94% at a time when SPY gained 0.01%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $117,459 which includes $355 cash and excludes $184 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.56% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained -0.46% at a time when SPY gained 0.01%. Over the period 1/2/2009 to 8/17/2015 the starting capital of $100,000 would have grown to $101,661 which includes $142,267 cash and excludes $19,739 spent on fees and slippage. |

iM-Best Reports – 8/17/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.