|

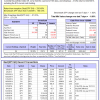

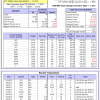

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 105 days, and showing a -3.54% return to 6/22/2015. Over the previous week the market value of Best(SPY-SH) gained -1.89% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $350,483 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 235 days, and showing a 5.53% return to 6/22/2015. Over the previous week the market value of iM-Combo3 gained -0.28% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $120,980 which includes $2,391 and excludes $1,242 spent on fees and slippage. | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained -1.03% at a time when SPY gained 1.82%. Over the period 1/2/2009 to 6/22/2015 the starting capital of $100,000 would have grown to $105,657 which includes $147,848 and excludes $18,648 spent on fees and slippage. | |

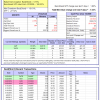

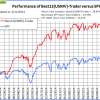

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 4 of them winners, so far held for an average period of 41 days, and showing a -0.09% return to 6/22/2015. Over the previous week the market value of iM-Best10 gained 0.94% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $827,814 which includes $246 and excludes $67,993 spent on fees and slippage. | |

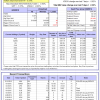

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 163 days, and showing a 6.59% return to 6/22/2015. Since inception, on 1/5/2015, the model gained 7.66% while the benchmark SPY gained 6.03% and the ETF USMV gained 3.93% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.68% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $107,656 which includes $810 and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 84 days, and showing a 0.69% return to 6/22/2015. Since inception, on 3/31/2015, the model gained 0.93% while the benchmark SPY gained 2.24% and the ETF USMV gained 0.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.11% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $100,932 which includes $670 and excludes $99 spent on fees and slippage. | |

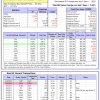

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 313 days, and showing a 20.44% return to 6/22/2015. Since inception, on 7/1/2014, the model gained 25.75% while the benchmark SPY gained 10.33% and the ETF USMV gained 13.17% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.91% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $113,174 which includes -$12,806 and excludes $152 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 225 days, and showing a 18.26% return to 6/22/2015. Since inception, on 9/30/2014, the model gained 18.39% while the benchmark SPY gained 8.87% and the ETF USMV gained 11.61% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.93% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $118,395 which includes -$115 and excludes $151 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.79% over SPY. (see iM-USMV Investor Portfolio) | |

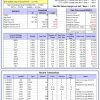

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 8 of them winners, so far held for an average period of 70 days, and showing a 4.19% return to 6/22/2015. Since inception, on 7/1/2014, the model gained 28.87% while the benchmark SPY gained 10.33% and the ETF USMV gained 13.17% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.96% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $128,873 which includes $99 and excludes $1,063 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 10 of them winners, so far held for an average period of 217 days, and showing a 9.81% return to 6/22/2015. Since inception, on 7/1/2014, the model gained 19.65% while the benchmark SPY gained 10.33% and the ETF VDIGX gained 8.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.32% at a time when SPY gained 1.82%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $119,646 which includes $106 and excludes $372 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.