|

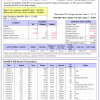

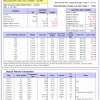

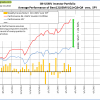

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 7 days, and showing a -0.70% return to 3/16/2015. Over the previous week the market value of Best(SPY-SH) gained -0.28% at a time when SPY gained 0.11% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $360,791 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

|

|

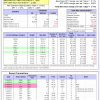

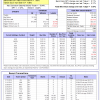

The iM-Combo3 portfolio currently holds SH, XLV, and TLT so far held for an average period of 137 days, and showing a 9.18% return to 3/16/2015. Over the previous week the market value of iM-Combo3 gained 0.06% at a time when SPY gained 0.11% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,823 which includes $1,151 in cash and excludes $1,146 in fees and slippage. |

|

|

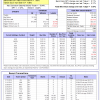

The iM-Best(Short) portfolio currently has 0 short positions. Over the previous week the market value of Best(Short) gained -1.65% at a time when SPY gained 0.11% Over the period 1/2/2009 to 3/16/2015 the starting capital of $100,000 would have grown to $104,919 which is net of $17,419 fees and slippage. |

|

|

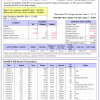

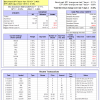

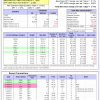

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 39 days, and showing combined 0.36% average return to 3/16/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -1.16% at a time when SPY gained 0.11% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $827,135 which includes $8 cash and excludes $62,436 spent on fees and slippage. |

|

|

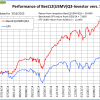

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 10 of them winners, so far held for an average period of 65 days, and showing combined 6.01% average return to 3/16/2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.08% at a time when SPY gained 0.11% A starting capital of $100,000 at inception of 1/5/2015 would have grown to $106,632 which includes $369 cash and excludes $134 spent on fees and slippage. |

|

|

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 241 days and showing combined 31.26% average return to 3/16/2015. Since inception, on 6/30/2014, the model gained 30.49% while the benchmark SPY gained 7.60% and the ETF USMV gained 12.36% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 1.61% at a time when SPY gained 0.11% A starting capital of $100,000 at inception on 6/30/2014 has grown to $130,491, which includes $64 cash and $128 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 148 days, and showing combined 20.27% average return to 3/16/2015. Since inception, on 9/29/2014, the model gained 18.26% while the benchmark SPY gained 6.17% and the ETF USMV gained 10.81% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 1.58% at a time when SPY gained 0.11%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $119,263 which includes $68 cash and $131 for fees and slippage. |

|

|

Average Performance of iM-Best12(USMV)Q1+Q3+Q4-Investor resulted in an excess return of 22.64% over SPY. (see iM-USMV Investor Portfolio) |

,

|

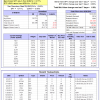

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 7 of them winners, so far held for an average period of 96 days, and showing combined 5.71% average return to 3/16/2015. Since inception, on 6/30/2014, the model gained 26.79% while the benchmark SPY gained 7.60% and the ETF USMV gained 12.36% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.11% at a time when SPY gained 0.11%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $126,790 which includes $16 cash and $833 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 195 days, and showing combined 10.10% average return to 3/16/2015. Since inception, on 6/30/2014, the model gained 16.55% while the benchmark SPY gained 7.60% and the VDIGX gained 7.96% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 0.97% at a time when SPY gained 0.11%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,546 which includes $382 cash and $302 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.