|

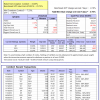

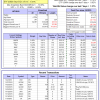

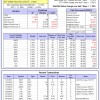

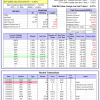

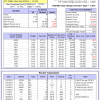

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

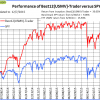

| The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 7 days, and showing a 0.02% return to 12/7/2015. Over the previous week the market value of Best(SPY-SH) gained 0.00% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $428,969 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SH, SSO, and XLB, so far held for an average period of 14 days, and showing a -0.27% return to 12/7/2015. Over the previous week the market value of iM-Combo3 gained -0.70% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $134,286 which includes -$35 cash and excludes $2,114 spent on fees and slippage. | |

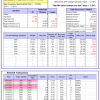

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 9 stocks, 2 of them winners, so far held for an average period of 144 days, and showing a -2.45% return to 12/7/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.46% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $425,099 which includes $193,184 cash and excludes $5,620 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 8 of them winners, so far held for an average period of 158 days, and showing a 4.30% return to 12/7/2015. Since inception, on 7/1/2014, the model gained 27.68% while the benchmark SPY gained 9.06% and the ETF VDIGX gained 10.88% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.65% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $127,678 which includes $214 cash and excludes $730 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 480 days, and showing a 40.76% return to 12/7/2015. Over the previous week the market value of iM-BESTOGA-3 gained 1.88% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $184,518 which includes $14,741 cash and excludes $805 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 7 stocks, 0 of them winners, so far held for an average period of 54 days, and showing a -7.22% return to 12/7/2015. Over the previous week the market value of iM-Best3x4 gained 0.34% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $99,629 which includes $317 cash and excludes $613 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 5 stocks, 0 of them winners, so far held for an average period of 55 days, and showing a -3.16% return to 12/7/2015. Over the previous week the market value of iM-Best2x4 gained 0.91% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $95,574 which includes $731 cash and excludes $411 spent on fees and slippage. | |

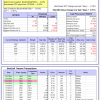

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 9 of them winners, so far held for an average period of 98 days, and showing a 2.48% return to 12/7/2015. Since inception, on 7/1/2014, the model gained 30.05% while the benchmark SPY gained 9.06% and the ETF USMV gained 15.94% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.63% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $130,048 which includes $200 cash and excludes $1,448 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 247 days, and showing a 4.78% return to 12/7/2015. Since inception, on 1/5/2015, the model gained 7.37% while the benchmark SPY gained 4.80% and the ETF USMV gained 6.47% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.27% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $107,366 which includes $201 cash and excludes $243 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 191 days, and showing a -6.22% return to 12/7/2015. Since inception, on 3/31/2015, the model gained 1.37% while the benchmark SPY gained 1.06% and the ETF USMV gained 2.84% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.39% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $101,374 which includes $101 cash and excludes $166 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 99 days, and showing a 4.19% return to 12/7/2015. Since inception, on 7/1/2014, the model gained 20.04% while the benchmark SPY gained 9.06% and the ETF USMV gained 15.94% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.07% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $120,040 which includes $245 cash and excludes $493 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 85 days, and showing a 3.37% return to 12/7/2015. Since inception, on 9/30/2014, the model gained 14.95% while the benchmark SPY gained 7.60% and the ETF USMV gained 14.34% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.82% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $114,950 which includes $122 cash and excludes $372 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 17.21% over SPY. (see iM-USMV Investor Portfolio) | |

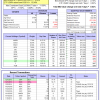

| The iM-Best(Short) model currently holds 2position(s), valued ($39,573). Over the previous week the market value of iM-Best(Short) gained 4.11% at a time when SPY gained -0.16%. Over the period 1/2/2009 to 12/7/2015 the starting capital of $100,000 would have grown to $103,593 which includes $142,961 cash and excludes $21,519 spent on fees and slippage. |

iM-Best Reports – 12/7/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.