|

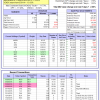

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 28 days, and showing a 0.84% return to 12/28/2015. Over the previous week the market value of Best(SPY-SH) gained -1.76% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $432,531 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SH, SSO, and XLB, so far held for an average period of 35 days, and showing a -1.54% return to 12/28/2015. Over the previous week the market value of iM-Combo3 gained 1.42% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $132,577 which includes -$1,887 cash and excludes $2,127 spent on fees and slippage. | |

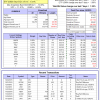

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 4 of them winners, so far held for an average period of 178 days, and showing a 4.54% return to 12/28/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.34% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $447,194 which includes $201,355 cash and excludes $6,003 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 4 of them winners, so far held for an average period of 155 days, and showing a 2.42% return to 12/28/2015. Since inception, on 7/1/2014, the model gained 26.43% while the benchmark SPY gained 8.05% and the ETF VDIGX gained 10.33% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.05% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,428 which includes $97 cash and excludes $812 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 501 days, and showing a 39.82% return to 12/28/2015. Over the previous week the market value of iM-BESTOGA-3 gained 1.22% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $183,718 which includes $15,065 cash and excludes $767 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 4 of them winners, so far held for an average period of 58 days, and showing a -8.73% return to 12/28/2015. Over the previous week the market value of iM-Best3x4 gained 1.05% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $102,827 which includes $107 cash and excludes $739 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 6 stocks, 2 of them winners, so far held for an average period of 64 days, and showing a -3.20% return to 12/28/2015. Over the previous week the market value of iM-Best2x4 gained 0.25% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $98,708 which includes $100 cash and excludes $513 spent on fees and slippage. | |

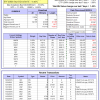

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 8 of them winners, so far held for an average period of 119 days, and showing a 1.16% return to 12/28/2015. Since inception, on 7/1/2014, the model gained 28.43% while the benchmark SPY gained 8.05% and the ETF USMV gained 15.83% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.73% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $128,428 which includes $262 cash and excludes $1,448 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 268 days, and showing a 2.15% return to 12/28/2015. Since inception, on 1/5/2015, the model gained 4.82% while the benchmark SPY gained 3.83% and the ETF USMV gained 6.37% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.25% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $104,816 which includes $41 cash and excludes $243 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 212 days, and showing a -7.55% return to 12/28/2015. Since inception, on 3/31/2015, the model gained -0.05% while the benchmark SPY gained 0.13% and the ETF USMV gained 2.74% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.80% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $99,954 which includes $111 cash and excludes $166 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 120 days, and showing a 2.24% return to 12/28/2015. Since inception, on 7/1/2014, the model gained 17.93% while the benchmark SPY gained 8.05% and the ETF USMV gained 15.83% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.49% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $117,926 which includes $370 cash and excludes $493 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 106 days, and showing a 1.30% return to 12/28/2015. Since inception, on 9/30/2014, the model gained 12.77% while the benchmark SPY gained 6.61% and the ETF USMV gained 14.23% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.55% at a time when SPY gained 1.76%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $112,773 which includes $22 cash and excludes $373 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.02% over SPY. (see iM-USMV Investor Portfolio) | |

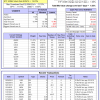

| The iM-Best(Short) model currently holds 0position(s), valued $0 . Over the previous week the market value of iM-Best(Short) gained 0.27% at a time when SPY gained 1.76%. Over the period 1/2/2009 to 12/28/2015 the starting capital of $100,000 would have grown to $104,695 which includes $104,695 cash and excludes $21,647 spent on fees and slippage. |

iM-Best Reports – 12/28/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.