To view latest asset allocation tables requires membership category: Bronze or higher.

System1a uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination, echoing the broad based Index approach. Best for the investors that do not want to give too much attention to their investments.

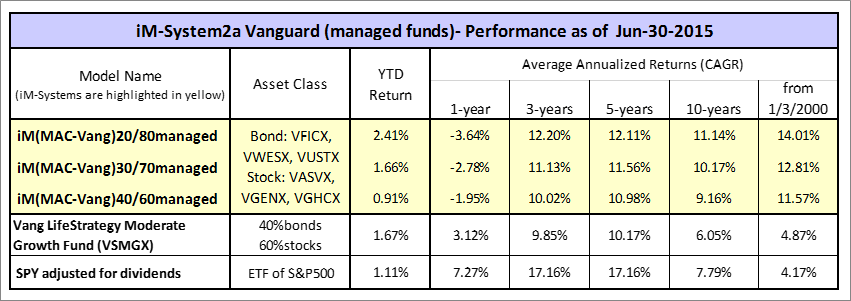

System2a uses six actively managed Vanguard funds with allocations optimized to produce the highest long-term return. Over the last 5 years this system has under-performed System1a and System3a.

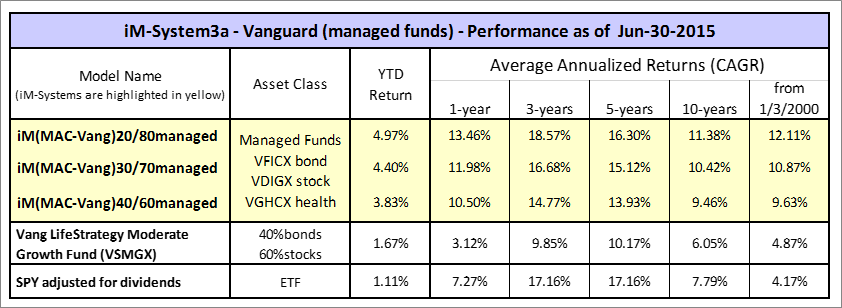

System3a uses three actively managed Vanguard funds with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund.

Hi, Georg,

I understand the various stock/bond allocations above, but I am curious if the Sector (healthcare) allocation will always be healthcare, or is there a method to choose a trending sector?

Good question. I would like to know this information as well.

Thanks

Georg,

Would it make any sense to use the Best1(Sector SPDR) to pick the appropriate sector or top 2 sectors when using system 2 or 3? It seems it would be worth back testing this.

Jon