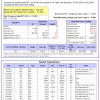

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 147 days, and showing 6.76% return to 9/22/2014. Please note the difference in returns over last 7 days is due to the way dividends are treated. Please see this view-thread.

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 147 days, and showing 6.76% return to 9/22/2014. Please note the difference in returns over last 7 days is due to the way dividends are treated. Please see this view-thread.

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $423,033 which includes $39 cash and excludes $10,609 spent on fees and slippage.

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 140 days, and showing a 10.09% return to 9/22/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 140 days, and showing a 10.09% return to 9/22/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $116,987 which includes $1,355 in cash and excludes $533 in fees and slippage.

The iM-Best(Short) position for 9/22/2014: shorts none; covers none. Over the previous week the market value of Best(Short) gained 0% at a time when SPY lost 0.8%.

The iM-Best(Short) position for 9/22/2014: shorts none; covers none. Over the previous week the market value of Best(Short) gained 0% at a time when SPY lost 0.8%.

Over the period 1/2/2009 to 9/12/2014 the starting capital of $100,000 would have grown to $111,229 which is net of $14,932 fees and slippage.

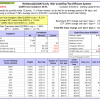

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 7 of them winners, so far held for an average period of 44 days, and showing combined 2.45% average return to 9/22/2014

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 7 of them winners, so far held for an average period of 44 days, and showing combined 2.45% average return to 9/22/2014

A starting capital of $100,000 at inception of 1/2/2009 would have grown to $825,231 which includes $36 cash and excludes $54,732 spent on fees and slippage.

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, and showing combined 7.99% average return to 9/22/2014, while the benchmark SPY gained 2.18% and the ETF USMV gained 2.20% over the same period.

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, and showing combined 7.99% average return to 9/22/2014, while the benchmark SPY gained 2.18% and the ETF USMV gained 2.20% over the same period.

A starting capital of $100,000 at inception on 6/30/2014 has grown to $108,209 which includes $332 cash and $100 for fees and slippage.

Could you tell me what the impact on hypothetical CAGR / drawdown for im-Best 10 is on Portfolio 123 when you enter/exit on Wednesday (WeekDay = 4) instead of Monday? Thanks.

–Tom C

Tom, the returns are marginally lower when trading on Wednesday.

CAGR= 42.0%, maxDD= – 28.3%, winners= 66%, Sharpe 1.60.