|

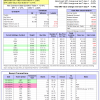

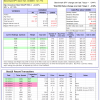

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 56 days, and showing -5.84% return to 12/15/2014. Over the previous week the market value of Best(SPY-SH) gained 3.44% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $378,463 which includes $3 cash and excludes $11,411 spent on fees and slippage. |

|

|

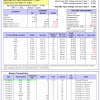

The iM-Combo3 portfolio currently holds SH, XLV, and TLT so far held for an average period of 123 days, and showing a 4.58% return to 12/15/2014. Over the previous week the market value of iM-Combo3 gained -2.08% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $118,528 which includes $1,696 in cash and excludes $874 in fees and slippage. |

|

|

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained 2.20% at a time when SPY gained -3.44%. Over the period 1/2/2009 to 12/15/2014 the starting capital of $100,000 would have grown to $110,508 which is net of $16,358 fees and slippage. |

|

|

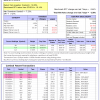

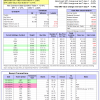

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 1 of them winners, so far held for an average period of 27 days, and showing combined -0.29% average return to 12/15/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained -7.01% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $785,146 which includes $944 cash and excludes $59,126 spent on fees and slippage. |

|

|

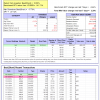

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 168 days and showing combined 18.84% average return to 12/15/2014. Since inception, on 6/30/2014, the model gained 19.23% while the benchmark SPY gained 2.36% and the ETF USMV gained 6.77% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained -1.26% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $119,230 which includes $107 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 77 days, and showing combined 10.34% average return to 12/15/2014. Since inception, on 9/29/2014, the model gained 10.53% while the benchmark SPY gained 0.99% and the ETF USMV gained 5.30% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained -1.63% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $110,532 which includes $133 cash and $100 for fees and slippage. |

,

|

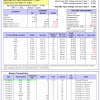

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 10 of them winners, so far held for an average period of 61 days, and showing combined 5.65% average return to 12/15/2014. Since inception, on 6/30/2014, the model gained 19.80% while the benchmark SPY gained 2.36% and the ETF USMV gained 6.77% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.64% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,803 which includes $2,153 cash and $578 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 136 days, and showing combined 10.16% average return to 12/15/2014. Since inception, on 6/30/2014, the model gained 11.79% while the benchmark SPY gained 2.36% and the VDIGX gained 3.48% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -2.66% at a time when SPY gained -3.44%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $111,795 which includes $16 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.