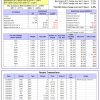

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 28 days, and showing -7.97% return to 11/17/2014. Over the previous week the market value of Best(SPY-SH) gained -0.22% at a time when SPY gained 0.19%.

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 28 days, and showing -7.97% return to 11/17/2014. Over the previous week the market value of Best(SPY-SH) gained -0.22% at a time when SPY gained 0.19%.

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $370,068 which includes $2,015 cash and excludes $11,409 spent on fees and slippage.

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 116 days, and showing a 8.60% return to 11/17/2014. Over the previous week the market value of iM-Combo3 gained -0.01% at a time when SPY gained 0.19%.

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 116 days, and showing a 8.60% return to 11/17/2014. Over the previous week the market value of iM-Combo3 gained -0.01% at a time when SPY gained 0.19%.

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $118,717 which includes $2,546 in cash and excludes $772 in fees and slippage.

The iM-Best(Short) portfolio currently has no short positions. Over the previous week the market value of Best(Short) gained -0.05% at a time when SPY gained 0.19%.

The iM-Best(Short) portfolio currently has no short positions. Over the previous week the market value of Best(Short) gained -0.05% at a time when SPY gained 0.19%.

Over the period 1/2/2009 to 11/17/2014 the starting capital of $100,000 would have grown to $108,006 which is net of $15,394 fees and slippage.

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 46 days, and showing combined 2.32% average return to 11/17/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.55% at a time when SPY gained 0.19%.

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 46 days, and showing combined 2.32% average return to 11/17/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.55% at a time when SPY gained 0.19%.

A starting capital of $100,000 at inception of 1/2/2009 would have grown to $811,799 which includes $161 cash and excludes $57,979 spent on fees and slippage.

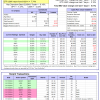

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 140 days and showing combined 15.20% average return to 11/17/2014. Since inception, on 6/30/2014, the model gained 15.58% while the benchmark SPY gained 4.85% and the ETF USMV gained 7.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 0.51% at a time when SPY gained 0.19%

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 140 days and showing combined 15.20% average return to 11/17/2014. Since inception, on 6/30/2014, the model gained 15.58% while the benchmark SPY gained 4.85% and the ETF USMV gained 7.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 0.51% at a time when SPY gained 0.19%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $115,578 which includes $107 cash and $100 for fees and slippage.

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 49 days, and showing combined 7.31% average return to 11/17/2014. Since inception, on 9/29/2014, the model gained 7.31% while the benchmark SPY gained 3.46% and the ETF USMV gained 6.25% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 0.49% at a time when SPY gained 0.19%

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 49 days, and showing combined 7.31% average return to 11/17/2014. Since inception, on 9/29/2014, the model gained 7.31% while the benchmark SPY gained 3.46% and the ETF USMV gained 6.25% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 0.49% at a time when SPY gained 0.19%

A starting capital of $100,000 at inception on 9/29/2014 has grown to $107,307 which includes $31 cash and $100 for fees and slippage.

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 44 days, and showing combined 2.82% average return to 11/17/2014. Since inception, on 6/30/2014, the model gained 16.39% while the benchmark SPY gained 4.85% and the ETF USMV gained 7.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.01% at a time when SPY gained 0.19%

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 44 days, and showing combined 2.82% average return to 11/17/2014. Since inception, on 6/30/2014, the model gained 16.39% while the benchmark SPY gained 4.85% and the ETF USMV gained 7.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.01% at a time when SPY gained 0.19%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,377 which includes $228 cash and $389 for fees and slippage.

Leave a Reply

You must be logged in to post a comment.